By: Doug Bevill on August 27, 2021

BPMs: Use the Right Data to Easily Monitor Your Market Share Trend

So, you’re a building product manufacturer and you’ve watched your sales continually rise in this latest, impressive expansion, up to the COVID -19 reset. The assumption would be that things are going well for your company, right? The evidence is in your sales growth chart, a nice steady line upward trend, correct? But is this enough evidence to prove you are growing as much as you could during this expansion? What more do you need to see or understand? With the correct data you can quickly answer these very important questions and chart your growth against the industry.

With my analytical nature and 18 years of experience, I have honed my craft of construction analytics, having worked with a litany of building product manufacturers (BPMs), distributors, insurance companies, and government agencies. It was with this expertise that I had switched gears to accept a C-level position with a leading global manufacturer of commercial and residential hinges, a company that held the dominant share of the market in the early 2000s.

Isolate Your Market Share Trend

In 2001, when I had started my new position, the company was coming out of the 1990s with quadrupled sales growth of commercial and residential products in aggregate, a steady upward sales trend. So, life was good, or so it appeared, until I asked another important question: “We were growing, but were we growing with the pace of market expansion?”

My curiosity led me to isolate the market share trend of our flagship commercial hinge products. In order to measure the true percent share of the market, it is necessary to model total product demand and then compare product performance against it to measure with any level of accuracy a product’s market share. This is a time-consuming and potentially expensive exercise and, in the outset, not all that necessary.

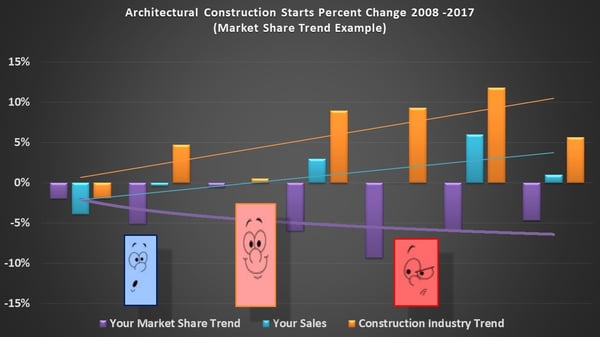

Rather than postpone doing this type of excavating, BPMs can use data to build a very simple graph. Below is the simple model that I completed using available data to quickly chart our market share trend in relationship to the market.

For the below model, I simply used the construction statistics that were available to me at that time to set a baseline. Since door hardware is only applicable to buildings with doors, I used construction value as my unit of measurement for educational, healthcare, commercial, office, and lodging. I then applied our commercial hinge sales over a 10-year period using construction starts as the data series.

Sample Market Trend Chart

The conclusion produced a different result depicting not only our sales trend, but also our market share trend. This new graph did not paint a very pretty picture. To the shock of my new employers, we had lost significant ground over the past four years, even though we had enjoyed significant sales growth.

Identify Growth and Losses

We were bleeding somewhere. Keep in mind, in a robust construction economy, it is easy to fall into a complacent mindset. Sales are booming, profits are up, what’s not to like? The issue is, if you are not paying attention to your share trend all the time, but especially in healthy times, your lack of attention will come back in a bad way when the economy corrects. And the economy always corrects.

In my examination in 2001, the data revealed that there was market share erosion and we needed to find where and why. Searching for the bleed we found our share of specifications for commercial hinges was not only maintaining its dominance, it was growing. Our orders for new construction were also stable and growing in share.

Dig Deeper to Identify Problems

This pointed to the replacement/over-the-counter hardware segment, which was traditionally 40% of our business. In surveying our distributor customers, we asked them which brands they were using for repair and replacement. Their consensus answer was overwhelmingly that they were using the Chinese brands, which were 30% less than our highly specified hinge.

A more qualitative analysis can be done to determine if the problem is with your specification share, or that you’re getting value engineered out of jobs by your competitors. Or, you could find you have a media problem; your product is not being seen by the targeted market audience of product specifiers that you need for your product to do well.

The correct quantitative data provides insight to a potential problem and the ability to monitor success and qualitative data and the right media will help you correct the problem.

(There is much more to this fascinating story, like how this data dive led to an investigation into offshoring some of our stock keeping units (SKUs), or a newly developed, more price-competitive brand for no spec, or open spec projects and over-the-counter replacement market. But the details of that are for another discussion.)

The fact is, in this case, I had access to the information needed, with construction analytics to dispassionately find and analyze the issue, a data source that allowed for the measured share of specification and tools to track projects from planning to procurement.

I am now very fortunate to work for a company that allows me to consult with manufacturers and assist in the application of these tools to execute winning, business building strategies for BPMs. Having the right data is crucial to analyzing the full scope of business success.

At ConstructConnect our BPM tools help manufacturers optimize their sales by bringing the industry’s building product specifiers and buyers together in “One Place” through unmatched marketing solutions that include:

- Specification solutions through AIA MasterSpec - targeted media tool

- Actionable project and company content through ConstructConnect Insight - sales analytical tool

Together, these products cover the construction process from preconstruction, through planning, bidding, and to product procurement.

With over 30 years of industry experience, Doug Bevill - Vice President at ConstructConnect, specializes in consulting with building product manufacturers on general strategy and optimal ways to leverage ConstructConnect’s best-in-class construction information and other marketing solutions to run their businesses.

With over 30 years of industry experience, Doug Bevill - Vice President at ConstructConnect, specializes in consulting with building product manufacturers on general strategy and optimal ways to leverage ConstructConnect’s best-in-class construction information and other marketing solutions to run their businesses.

Prior to joining ConstructConnect, Doug held executive positions with FläktGroup SEMCO, a leading manufacturer on energy recovery technology; The Hager Companies, a global door hardware manufacturer; and is the past president of BIMobject Inc., a global construction technology company.

Sign In

Sign In