- Find Projects

- Find Subcontractors

-

Solutions

Subcontractors

Subcontractors find more project leads, get promoted to general contractors, organize and manage bid opportunities on your online bid board, and perform digital takeoffs.

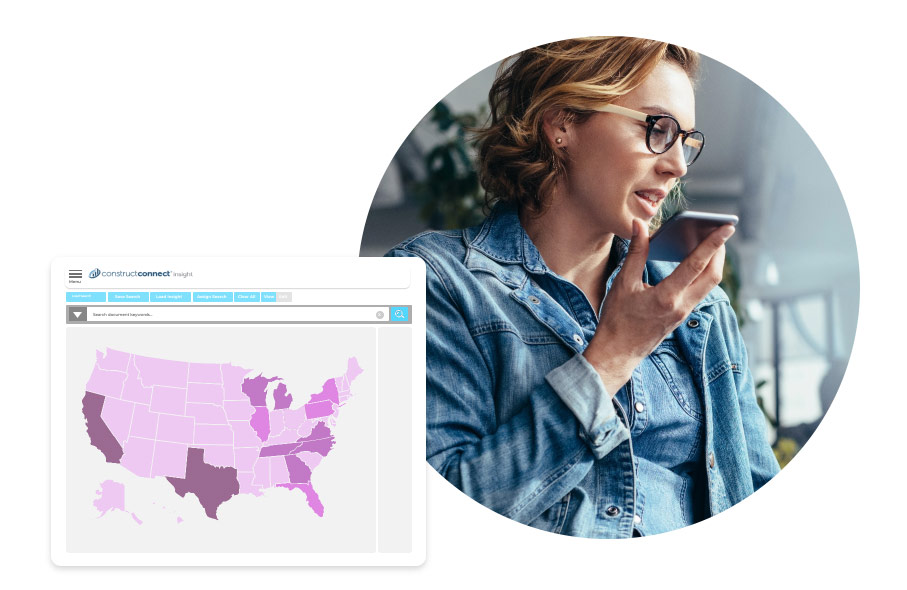

Find More BidsSuppliers & Distributors

Outsell your competition with quality construction leads. Identify new opportunities, review market trends, and make the right connections to better understand demand and sell your products.

Get Your Products SoldGeneral Contractors

Ensure bid coverage and improve your response rate with the largest network of commercial subcontractors, and discover new bidding opportunities to win more work.

Quickly Create & Send Bid InvitesBuilding Product Manufacturers

Increase your specification rate, grow your market share, and maximize your selling power with actionable project leads, data-driven insights, and construction industry trends.

Get Your Products SpecifiedTakeoff & Estimating

Find the right digital takeoff solution for your construction business from trade-specific takeoff tools to a fully integrated construction estimating suite.

Perform Digital TakeoffsService Providers

Find construction bids needing your services, connect with contractors and general contractors bidding projects in your area, and see which projects your competitors are quoting.

Drive Stronger Sales -

Products

Building Product Manufacturers

-

Resources

Blog

Read up on the latest commercial construction news, hot projects, construction technology, operating insights, economics, and more.

Read the BlogVideos & Webinars

Check out our latest product videos and economic webinars.

Watch. Replay. Repeat.Economic Resources

Economic news, webinars, monthly construction starts, quarterly forecasts, annual put-in-place forecasts, and more.

See Economic ResourcesSpecification Resources

Access the AIA's Architect's Journey to Specification reports and blog posts focused on getting your building products specified.

View ResourcesConstruction Estimating Survival Kit

Our Construction Estimating Survival Kit helps make estimating easy with blog posts, eBooks, and tools to help you bid better and win more jobs.

Grab the Survival KitConstruction Economic News

Read the latest economic news impacting the construction industry with insight from Chief Economist Alex Carrick and Senior Economist Michael Guckes.

Construction Economic NewsArchitects, Project Owners, & General Contractors

Increase exposure to your construction projects and reach more bidders by sharing your projects with our extensive contractor network.

Share Your ProjectsCase Studies

Take the customer journey with exclusive insight and success stories straight from them.

Explore Customer Stories - About

Sign In

Sign In