ECONOMICS

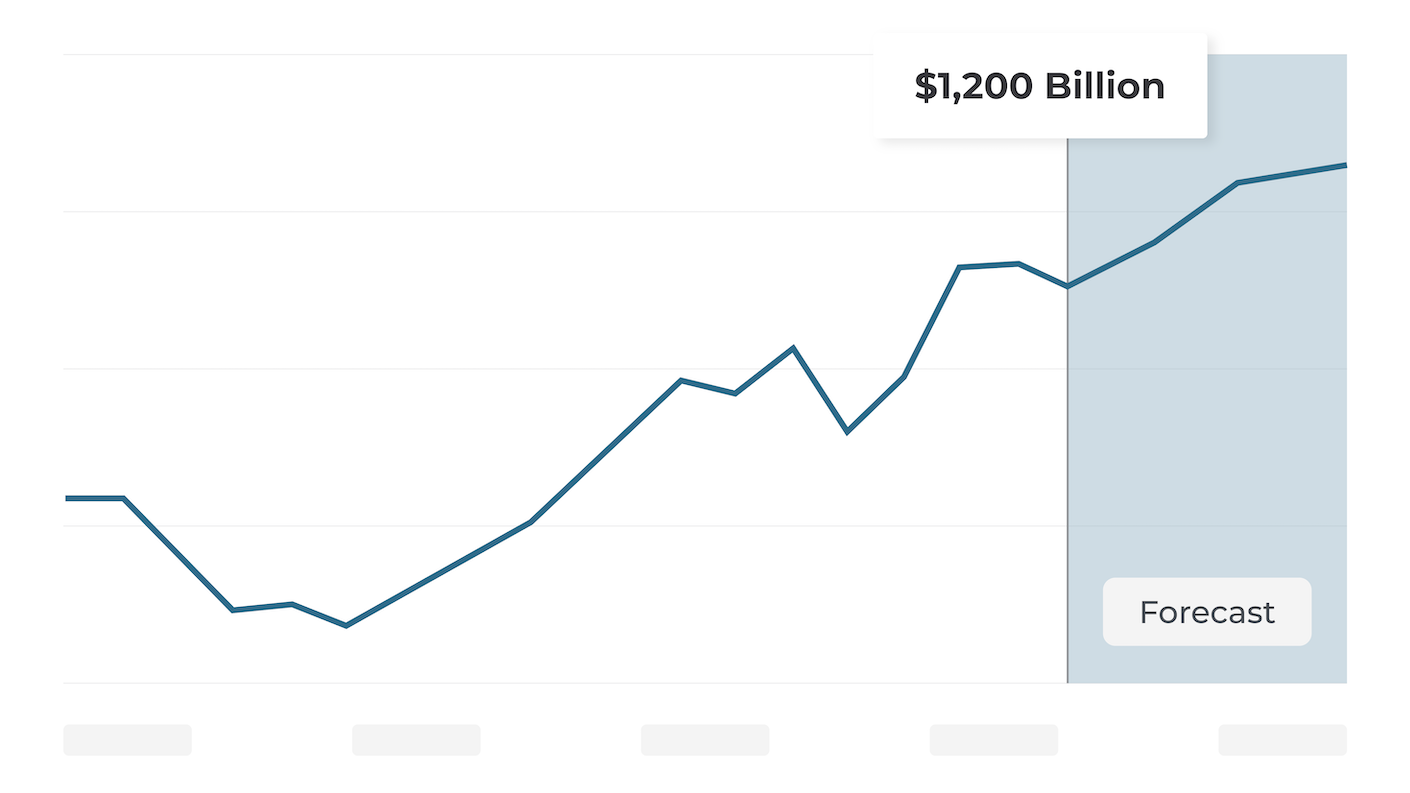

Construction Starts Forecast

Find the latest quarterly Construction Starts Forecast Report to get a five-year forecast of construction starts by type of structure and by state as well as drivers influencing each building sector.

ECONOMIC RESOURCES

Check Out The Latest Construction Economic Trends

FORECASTS

U.S. Put-In-Place Forecast

Get an overview of residential and nonresidential put-in-place expectations over the next five years

REPORTS

Construction Economy Snapshot

Get the latest month's construction starts in our monthly report, along with trend graphs, regional starts data, and more.

DATA

Expansion Index

Compare the total dollar value of construction projects in planning with a year over year view.

ABOUT OUR ECONOMIST

Michael Guckes, Chief Economist

Michael Guckes is regularly featured as an economics thought leader in national media, including USA Today, Construction Dive, and Marketplace from APM. He started in construction economics as a leading economist for the Ohio Department of Transportation. He then transitioned to manufacturing economics, where he served five years as the chief economist for Gardner Business Media. He covered all forms of manufacturing, from traditional metalworking to advanced composites fabrication. In 2022, Michael joined ConstructConnect's economics team, shifting his focus to the commercial construction market. He received his bachelor’s degree in economics and political science from Kenyon College and his MBA from the Ohio State University.