According to CME Group, an American global markets company and exchange operator, and The Wall Street Journal, CME Group will be introducing a new futures contract using ticker “LBR” starting as early as August 2022. This could be a significant benefit to smaller sawmills along with general and trades contractors involved in housing construction. Among the primary reasons are:

1. The physical size of the contract has been reduced from that of a railcar to a truckload which is a much more convenient unit of measure given its proximity to the amount of lumber required when building an individual home as compared to the much larger capacity of a railcar.

2. The new market will be expanded to include eastern species of wood. The former lumber exchange only allowed for western species.

3. If smaller truck-size units are traded at greater frequency, it could give the industry a more accurate tool for assessing the true clearing price of lumber. In contrast, the present system which uses railcars as the unit of measure, a volume that is approximately six times the size of a truckload, needs fewer daily trades to buy and sell a given volume. This reduces the number of necessary daily trades and as a result, if a few such trades are executed in close timing to one another it can result in substantial price swings that do not reflect the true supply and demand of the lumber market.

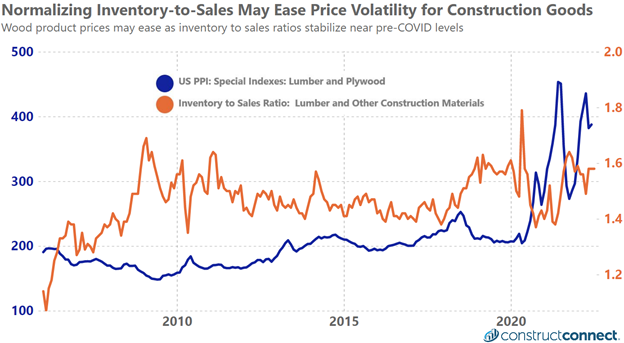

As reported by ConstructConnect’s economics team in recent months, significant increases in mortgage rates, declining consumer confidence, and falling savings among other events are likely to have a significant downward impact on the demand for housing and by extension wood products for the remainder of 2022 and potentially beyond.

Despite this, in a recent ConstructConnect survey it was found that a significant portion of the industry continues to purchase excess inventory as a solution for controlling costs and inventory. The creation of this new lumber options market will give contractors a meaningful alternative for managing inventories and expenses, especially at a time when wood product prices remain elevated compared to historic norms.