The March 10, 2023, collapse of Silicon Valley Bank, followed days later by the failure of Signature Bank, sent shockwaves through financial markets. The cause of their failures was similar in that both experienced dramatic deposits growth in the years just prior to the latest surge in inflation and rates.

As is typical with many banks, much of those deposits were invested in safe investments, including government treasury debt. Historically, banks generate revenue by offering a lower rate of interest to their depositors while collecting a higher rate of interest from the bills and bonds they purchased with those same deposits. The challenge that these banks failed to anticipate, and which is still a threat to the industry at large, is that while the said bills and bonds are considered safe—in the sense that the U.S. government is extremely unlikely to default on its debts—that does not mean these instruments can’t lose value.

During the 12-month period ending with the third quarter of 2022, short-term treasury rates exploded. In the specific case of two-year treasuries, there was an eightfold rate increase in their rate from 0.25% to 4.0%. The consequence of this rapid rate rise is that older treasuries paying paltry interest have fallen in face value to compensate for their meager returns.

Consider this “what would you rather have example” based on five-year treasury data: Would you spend almost $1,000 to buy an old investment that will pay you $2.50 a year, or would you rather spend that same $1,000 on a new investment that will pay you $37.50 a year?

The obvious answer is you would want the new instrument, and the only way the two offers could be equalized is if the person selling you the old investment sold it to you for far less than the $1,000 price of the new instrument. While highly simplified, this scenario exemplifies just how drastic the problem is at the banks and why if they had to sell their old treasuries, they could quickly find themselves in a dire situation.

Any indication that a bank may be in trouble could risk even a modest run on its deposits, forcing it to sell some of its stockpile of treasury debt at a loss to cover those withdrawals. This would turn paper losses on those old treasuries into actualized losses.

Once its depositors learn that the bank is selling its old bonds and now realizing those losses, it could quickly spark a full-blown bank run. (However, before you run to pull your money from your bank, remember that many institutions have done a good job of managing this risk, and furthermore, bank account deposits up to $250,000 are insured by the government.)

Why This Matters to Construction

The precarious position of the banks at present means they have an extreme incentive to lend to only the safest borrowers in order to protect their image as safe institutions. This has been reflected in the punitively high yield on high-risk (CCC-rated) borrowers, which includes many small and new businesses. The CCC rate increased between the second quarter of 2021 and the fourth quarter of 2022 from under 7% to nearly 17%.

During the year-to-date period ending in mid-April, the interest on CCC-rated debt trended downward to a still punitive 15.2%. Conceptually, such high borrowing costs will drive smaller construction firms towards only jobs with extremely high ROIs that can cover both the cost of a 15% loan rate and still offer a positive return to the contractor. Contractors with even modest credit ratings will have a significant advantage over their less credit-worthy competitors. A BBB-rated contractor, for example, could borrow at an effective rate of 5%, according to the same credit data provider.

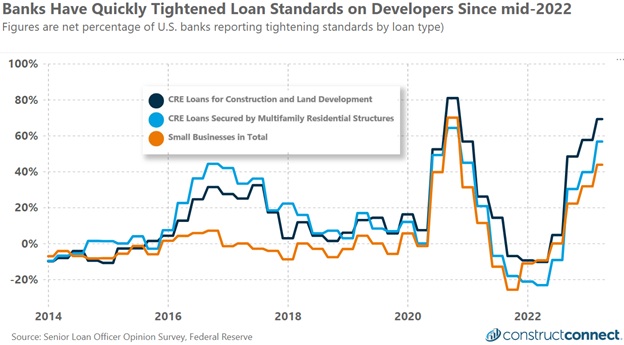

Secondly, the willingness of banks to lend money for commercial real estate has dramatically fallen, according to the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices. This turning away from commercial real estate lending will diminish the demand from owners and developers to construct tomorrow’s projects. As owner and developer demand softens, its impact will ultimately be felt through the greater construction industry.

Lastly, recent data from the American Institute of Architects appears to support this challenging finance narrative as the AIA’s Billings Index has posted sequential contractionary readings since October of 2022. The AIA logically claims that its indexes serve as leading indicators to the construction industry because of the early-stage involvement of architects in the construction process.

How Contractors Can Respond to Rising Borrowing Costs

Construction firms have limited options for responding to a financial market that has decidedly turned against the industry. In this environment, contractors must be discerning and prudent in two specific ways and diligent in a third.

- Be selective about which developers and customers you will serve. Research the financial history of potential clients. For a small fee, contractors can obtain the financial history of potential clients, including their creditworthiness and the number of past liens and judgments that are, or have been made, against them. Should financial market conditions continue to harden against developers, it may be in the best interest of the contractor to look elsewhere for work.

- Clearly define your payment requirements and enforcement. When contracting with a developer whose financial strength is poor or unknown, a contractor can protect him or herself by reducing their net payment terms and setting conditions for what is to happen if payment terms are breached. The consequences of a breach in payment obligations can be wide-ranging, from stopping all work to a further reduction in net payment terms, or even the use of an escrow or retainer account to ensure funds are available for costs incurred.

- Thoroughly document everything you do. In a situation where the courts must get involved, it is critical for the contractor to have evidence that proves they performed the contracted work. Proof of work performed (and to the accepted standard) will not only improve a contractor’s chances of a successful outcome but also keep the defendant from being able to use the defense that they withheld payment due to poor work.