The recent history of global energy price movements is unprecedented. Not since at least World War II have energy firms, or their customers, experienced the severity and frequency of price shocks that have occurred as a result of COVID-19 and, more recently, the war in Ukraine.

The multiple disruptions to supply chains and critical global infrastructure between 2020 and 2022 have no precedent. No portion of the world was possibly more harmed by these events than the European Union, which recently experienced its highest energy prices in recorded history extending back to early 1974.

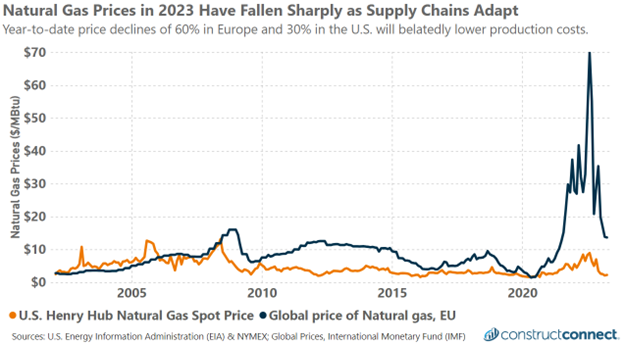

Thankfully, reduced energy demand in Europe due to an unusually warm winter and the expanding capacity and throughput of the global LNG supply chain, including a growing armada of LNG tankers, have helped bring down energy costs drastically from a year ago. In the four months ending April 30, 2023, U.S. spot prices fell 61% to end at $2.27 per million Btu (MBtu); however, they fell an even more dramatic 75% from last year’s summer peak of $8.81 per MBtu according to data from the Energy Information Administration. More recent readings have seen prices at or below pre-pandemic levels when prices fluctuated between $2.00 and $2.50 per MBtu.

European energy prices, in contrast, remain significantly above their pre-pandemic rates, largely resulting from the absence of Russian energy imports due to the Russian-Ukraine war. However, despite Europe’s greater amplitude in price changes over the last three years, the directional change follows that of the United States.

The latest pricing data indicates a 61% and 80% decline in spot prices since December and August 2022, respectively. The decline in prices on both sides of the Atlantic will belatedly, but substantially help lower the cost of manufacturing energy-intensive construction products. Although U.S. and European manufacturers are—or soon should be—seeing lower prices in their energy contracts, the relative difference remains significant, with European firms paying $11 more per MMBtu than their U.S. counterparts, according to the latest available data.

This latest premium, however, is significantly smaller than the $32 and $64 premiums of four and eight months ago, respectively. This will continue to give American manufacturers a cost advantage, albeit a shrinking one from just months ago.

Supply chain investments in LNG export and import terminals, along with a growing fleet of LNG tankers crisscrossing the globe, should help support and stabilize the Western world’s use of natural gas. At the end of 2021, there were an estimated 700 LNG tankers. The following year a further 163 LNG carriers were ordered, a record high, according to Refinitiv.

That pace has since halved, with 26 new LNG carrier orders placed in the first four months of 2023, according to Wood Mackenzie. This increase in fleet size, coupled with a growing number of worldwide LNG terminals, will help relieve the energy price volatility of the recent past and see vessel daily charter rates fall significantly. Atlantic LNG day rates have already tumbled from a peak of $480,000 in October 2022 to $40,000 in late May, according to data from Spark Commodities and published by LNGPrime.

While there will always be the potential for disruptions to energy markets, the investments being made in global LNG infrastructure are undoubtedly making this market both more efficient and resilient. For manufacturers in North America and Europe, the benefits of these investments will appear in the form of more stable energy prices when future shocks inevitably arise.

Few manufacturers may benefit more than those producing energy-intensive building products and construction goods, where volatile pricing can play havoc with total production costs. In a more stable energy market, smaller energy price fluctuations will provide for more stable production costs, reducing the severity and frequency of operational losses caused by the characteristically slower ability of firms to adjust product pricing compared to their to manufacturing costs.