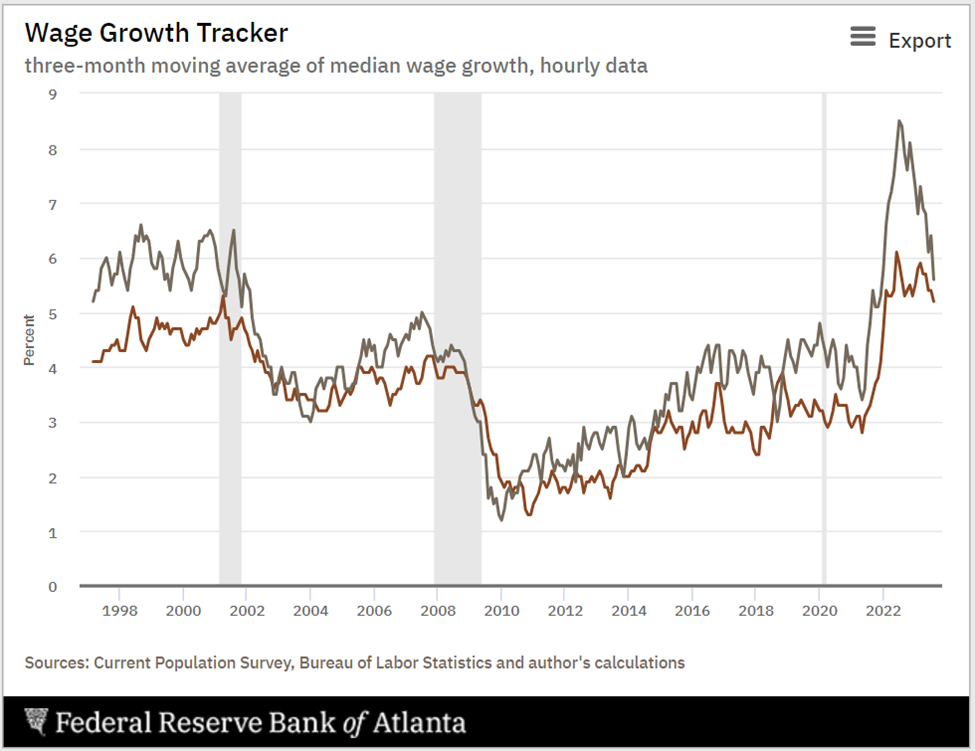

According to the Federal Reserve Bank of Atlanta’s wage tracking data through August 2023, job switching no longer pays the considerable premium that it did as recently as the first half of this year. Measured as the three-month moving average of median wage growth in hourly pay, August’s results indicated 5.2% and 5.6% wage growth for job stayers and switchers respectively across all industries. At the peak of the wage growth disparity in mid-2022 job switchers experienced nearly 3% greater wage growth relative to job stayers. The collapse of this premium has come about entirely from the decline in the wage premium being offered to switchers in 2023.

Despite the recent slowing growth trend in the wages of job switchers, all employees continue to experience historically above-average wage growth thanks to COVID’s impact on the supply and demand of labor. Since the start of 2022 the wage growth of job stayers has remained relatively constant, oscillating between 5.3% and 6%. During no other period in at least the last 25-years has the wage growth of job stayers been this great. Similarly, recent trends in job switcher wage growth also have no equal over the same period. Since 2022 the average wage growth of job switchers at 7.2% has easily exceeded that of the previous most favorable period. In that period between 1998 and 2000 the average job switcher experienced wage growth of 6.0%.

The available wage data anecdotally appear to imply two truths. The first is that the directional trend in job switcher wage growth directionally foretells the trend in comparable job stayer data. Strong directional trend change movements in the wages of job switchers going into the 2008 recession, the 2010 recovery, and the post-COVID economic recovery of 2021 all illustrate this leader-follower relationship. Secondly, although the wage growth of job stayers is highly correlated with that of job switchers, employers in general during each economic expansions also collectively “cap” wage growth for job stayers. This is evidenced by the unique plateaus visible only in wage stayer data during the late-1990’s, mid-2000’s, and most recently since 2022. Employers are willing pay the market rate for new labor even if it comes with at a heavy wage premium. However, their methodology for compensating existing employees is determined using alternative determinants.

Historic results suggest that if the wage growth of job switchers continues to slow, so will the ability of job stayers to also demand higher wages. How soon and how severely this latest trend in overall slowing wage growth will impact the construction industry is difficult to determine; however, it is certain to happen. Among the seven industries tracked by the Atlanta Fed, the Construction and Mining industry is one of the few that continues to experience accelerating wage growth in 2023. Other industries including Trade and Transportation, Manufacturing, and Leisure and Hospitality have already seen their wage growth rates climax and now beginning to decelerate. Regardless, time appears to be against the side of construction employees hoping to negotiate for strongly higher wages in the future.