During the decade between the Great Recession and the coronavirus pandemic (2010 – 2020), the U.S. economy added an average of 180,000 workers monthly. Had this trend not been interrupted by COVID-19, the United States would theoretically have added nearly 6.5 million new workers during the three-year period ending January 2023, cumulating in a total employed persons count of just over 165 million.

Compared to this trended figure, the actual number of employed persons stood at 160.1 million in January 2023, representing a much smaller gain of only 1.3 million workers. These missing 5.2 million workers are why labor has become—and will remain—the greatest constraint to economic growth in 2023 and for years to come for every corner of the economy.

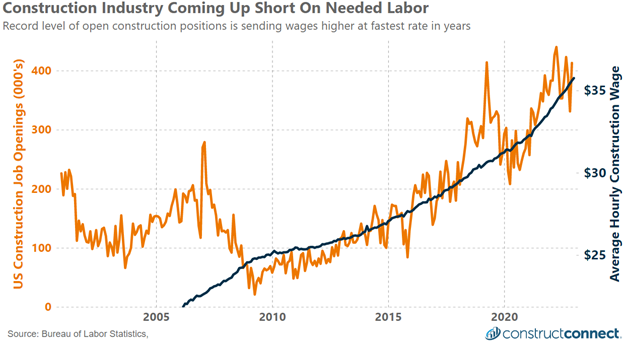

Many business owners are well aware of the consequences resulting from today’s labor shortage: higher wages and lower productivity. Construction wages have increased by over 5% in each of the last two years. Despite such historically large wage increases, there are over 100,000 more construction job openings now than before COVID-19, and the most in decades. Furthermore, the replacement of experienced workers for more green and less qualified workers since 2020 has now resulted in contracting per-worker productivity.

There are limited options that construction business owners have:

“Steal” workers from other industries:

Hourly manufacturing wages are, on average, $31.57, putting them more than $4 per hour below those of construction. For families seeking to maintain their former standard of living, or to improve their existing standard, trading a manufacturing job for a construction position offers a 13% wage premium based on these average figures.

Watch for struggling industries that may be reducing their employee benefits, hours, and even payrolls:

Using the manufacturing sector again as an example, new orders and production activity readings beginning in late-2022 began signaling contractionary conditions. The decline in new orders, production, and backlog readings. The Institute for Supply Chain Management offers such data for free, where they monitor business activity levels for the services industries, goods-producing industries, and specifically for manufacturing.

Invest in existing employees and offer incentives to potential and new hires:

Fourth quarter 2022 readings of output per hour pointed to a 1.5% decline, the first since COVID-19 disrupted the economy in early 2020. In the last 35 years, there have only been three instances where productivity contracted for longer than one quarter, but in no instance was the loss of experienced workers (and who are unlikely to ever return to the labor force) ever as impactful as it is now.

To address this structural change in the labor market, business leaders will need to think outside the box about how they are going to attract talent and improve per-person productivity to collectively fill the gap from these missing millions of workers. Firms that lead the way in internal training programs and or collaborate with vocational schools and union training may see greater returns on their efforts than at any time in the recent past.