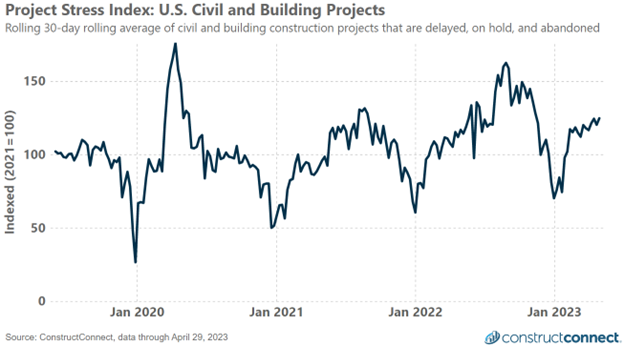

Earlier this year ConstructConnect began publishing a new data product named the Project Stress Index. The strength of the PSI resides in its ability to monitor the weekly level of projects that have had their bid date delayed, have been put on hold, or have been abandoned. The independent rise and fall in the level of projects experiencing each type of event, along with their interdependent behavior, may better allow market watchers to distinguish normal market volatility from actual turns in the market.

The Project Stress Composite Index is the average of the indexed readings for the level of projects with delayed bid dates, the level of projects on hold and the level of projects abandoned.

The Project Stress Composite Index is the average of the indexed readings for the level of projects with delayed bid dates, the level of projects on hold and the level of projects abandoned.

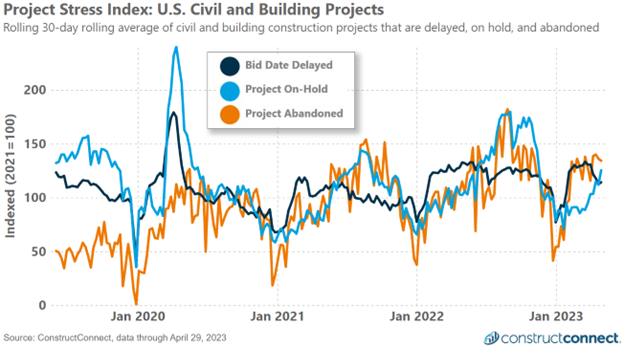

The individual components of the PSI each exhibits a unique seasonal behavior. While all three seasonally decline at the end of the calendar year, it is their independent behaviors during the rest of the year that provides a rich understanding of industry conditions.

In a typical calendar year, the level of projects with delayed bid dates rapidly recovers over the first quarter of the year followed by more slowly rising levels of projects placed on hold or abandoned.

During the second half of each calendar year the level of delayed bid projects recedes while on hold and abandoned levels peak sometime during the third quarter.

Elevated levels of abandoned projects have disproportionately contributed to the recent elevation in the overall composite reading of the PSI.

Elevated levels of abandoned projects have disproportionately contributed to the recent elevation in the overall composite reading of the PSI.

This year’s unique first quarter acceleration of on hold and abandoned project levels suggest that there is more happening than is evidenced by the composite’s top-line reading. The April 29, 2023, composite reading at 124.6 is only 6.8% above its year-ago level, suggesting a modest but not overly concerning increase in overall stress conditions.

However, it is what is underlying this modest increase that should have the industry taking notice with a 14% decline in delayed projects and a 23% and 17% increase in on hold and abandoned projects, respectively.

In effect, the first quarter’s elevated readings were entirely due to the more severe forms of project stress that typically do not manifest themselves until much later in the calendar year. If the influence of delayed project levels was remove from the composite reading the PSI would be a concerning 20% above year-ago levels.