With trillions of dollars on the line and reputations at stake, banks have a strong incentive to accurately gauge the future of the economy. If the economy appears as though it is about to falter, banks have several ways to protect themselves from losing money or even risking their solvency. In short, banks can increase, or tighten, their loan standards, granting loans only to entities that they perceive as being the safest risks and hence more likely to pay back their loans.

Put in other words, tightening standards also result in higher loan application denial rates amongst those who would have qualified just months ago. The second action that banks can take is to increase the amount of money they keep aside to cover bad loans. Inside banks, this is known as the Account for Loan and Lease Losses, or ALLL balance.

Tightening Standards Are Resulting in More Contractors Being Denied Loans

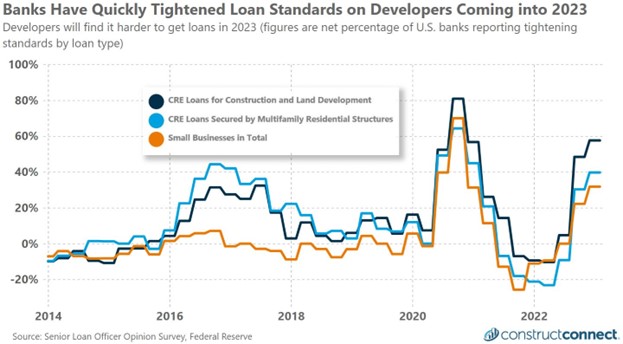

Between the first and fourth quarters of 2022, the net percentage of U.S. banks reporting tightening standards for commercial real estate loans drastically increased, from -23% to +40%. This +60% change marks one of the fast changes in banking standards since the Great Recession.

Making matters even more difficult for the construction industry, the net percentage of banks tightening their loan standards for CRE loans for construction and land development purposes rose to a modern-day high of 58% in the fourth quarter after registering one of the most favorable conditions for loan applicants at the end of 2021. Compared to overall loan standards for large and small businesses, banks are taking a particularly cautious approach to CRE loans.

The second method by which banks can protect themselves if they believe that economic headwinds are upon them is by increasing the cash they hold aside to cover potential losses on bad leases and loans (ALLL). Here too, banks are tipping their hand as to their 2023 expectations.

The amount of funds held back for ALLL increased by 13% during the last six months of 2022. For comparison, today’s ALLL level is 53% greater than at the end of 2019. Again, the last time that pre-pandemic ALLL levels were this high was during the aftermath of the Great Recession.