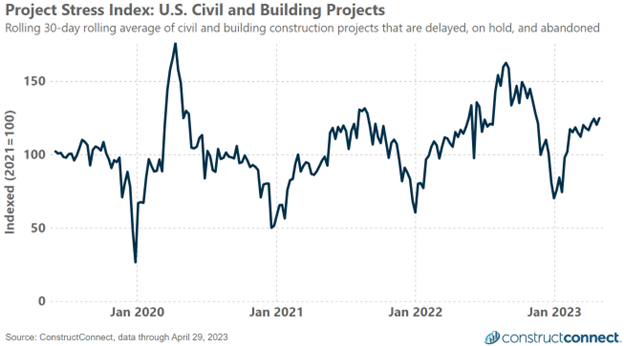

Earlier this year ConstructConnect began publishing the Project Stress Index, a proprietary resource tracking the weekly level of projects failing to move towards expected completion.

The strength of the PSI resides in its ability to monitor the weekly level of projects that have had their bid date delayed, have been put on hold, or have been abandoned. The independent rise and fall in the level of projects experiencing each type of event, along with their interdependent behavior, will ideally allow market watchers to distinguish normal market volatility from actual turns in the market.

The Project Stress Composite Index is the average of the indexed readings for the level of projects with delayed bid dates, the level of projects on hold, and the level of projects abandoned.

The Project Stress Composite Index is the average of the indexed readings for the level of projects with delayed bid dates, the level of projects on hold, and the level of projects abandoned.

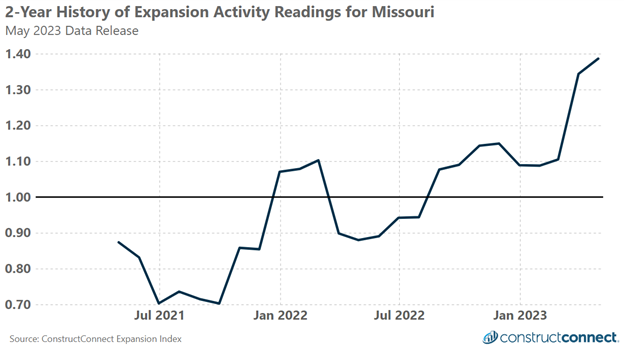

As many are already aware, ConstructConnect offers construction industry insights at the geographic level through its Expansion Index. The Expansion Index database allows anyone free access to contemplated construction spending data at the national, state/province, and metropolitan statistical area levels.

In its latest release, the state of Missouri ranked among the top five fastest-expanding states based on contemplated spending as of April 2023. Compared to April 2022 results, today’s level of contemplated spending is 39% higher.

Part of the reason for the state’s impressive expansion readings in recent months is due to 15 new planned projects in 2023, each of which is estimated at or above $100 million, according to ConstructConnect’s data. The total estimated value of the top ten projects alone exceeds $2 billion.

When a small number of high-value projects can impact broad-level results, it is important for contractors to have alternative means by which they can assess a particular geographies’ construction prospects. The Expansion Index allows contractors to do this in part by examining activity at the metropolitan level as well as by market vertical, giving them powerful information about contemplated construction activity in granular detail.

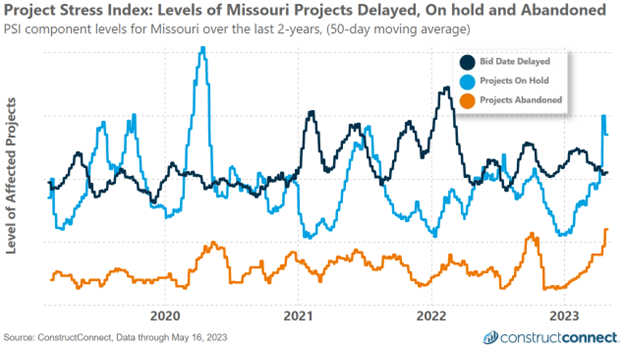

However, without help from the PSI, it can be difficult to estimate what portion of these planned projects will make it to completion, or even break ground. An array of market headwinds in 2023 could keep substantial numbers of such projects from ever being more than just blueprints. This is why it is important for industry leaders to use the collective insights of multiple tools to estimate a region’s true level of construction prospects.

As an example, PSI data for Missouri provides several insights that can help refine a contractor’s understanding of Missouri’s construction prospects beyond what is possible using only the Expansion Index.

As we approach mid-year, the level of abandoned Missouri projects has already reached multi-year highs. While part of this is a result of seasonality, peak 2023 levels are above the peak levels reached in all years since at least 2019. Of additional concern is the fact that Missouri reached such a level of abandoned projects relatively early in the 2023 construction season.

Historically Missouri, like most states, does not reach peak levels of abandoned projects until sometime between June and September each year. Elevated levels of on hold projects in 2023 should give industry leaders further reason to temper their outlooks for the state’s construction prospects. April 2023 saw on hold project counts reach their highest level in almost two years. As of April 2023, the level of projects on hold was 57% above those recorded in April a year ago.

As with abandoned project levels, the rate of increase in projects put on hold resulted in an exceptionally early climax relative to past seasonal results. All of this suggests that 2023’s industry conditions are less than ideal and may require some discounting of the contemplated construction spending suggested by the Expansion Index.

Assessing the prospects of the construction industry is always a challenging task. The industry’s intricate nature requires forward-looking leaders to have a mastery understanding of its numerous dynamics, and an ability to convert this information into actionable direction for the company. In this regard, the combined insights from the Expansion Index and the PSI, using Missouri as an example, offer a powerful starting point for such work.

By integrating the market sizing data from the Expansion Index with the real-time industry conditions provided by the PSI, leaders can perform market assessments in ways never previously possible. Leaders who choose to layer additional market analytics tools into their market understanding and assessments can build even more comprehensive and distinctive strategies that allow them to outsmart the competition.