ConstructConnect Releases US Put-in-Place Construction Forecasts - Fall 2024

ConstructConnect leading provider software solutions for the construction industry releases the US Construction Put-in-Place Forecast of...

Economic highlights from the United States and Canadian construction markets, in partnership with Oxford Economics

US Economy in a Nutshell

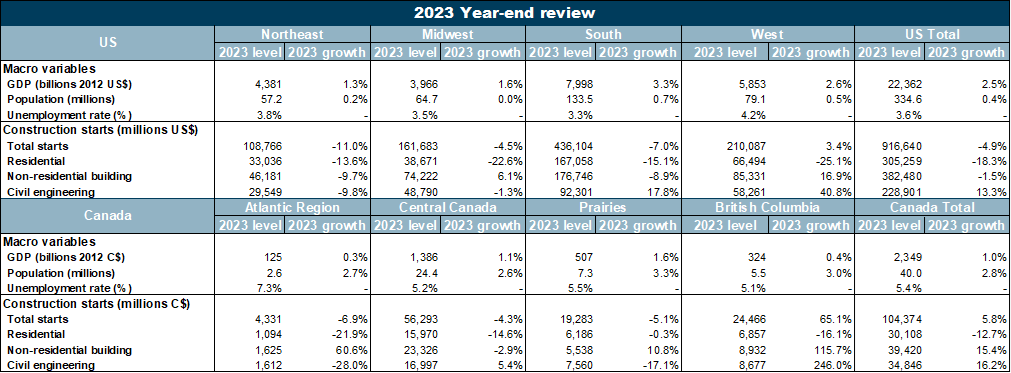

US construction starts contracted by 4.9% in 2023 to a value of $917 billion. The growing trend in megaprojects (those above $1 billion) continued in 2023, with the total value of such projects at a similar level to 2022. Non-residential building fell 1.5% after posting robust growth in the previous year. New residential building fell 18.3% on single-family and multi-family homebuilding declines. Civil engineering construction, by contrast, increased 13.3%. Construction starts declined in all major regions except the West in 2023.

Canadian Economy in a Nutshell

Canadian construction starts rose 5.8% in 2023 on solid growth in both new non-residential building and civil engineering. Non-residential building grew 15.4% with considerable variation across the sub-sectors. New engineering projects increased 16.2%. New homebuilding, by contrast, fell 12.7%, as rising interest rates and the ongoing house price correction took their toll.

The US Year in Review

2023 began with many forecasters predicting a recession in the US. But the US economy continually surprised to the upside, with annualized GDP growth above 2% throughout the year and even accelerating towards the end of the year. US GDP grew 2.5% in 2023 as a whole.

Consumers

The US consumer continued to prop up the economy despite inflation still above the Fed’s 2% target. Households were boosted by continuing strength in the labor market. The economy added an average of 255,000 non-farm jobs per month through the year, although job growth did slow through the course of the year. Average earnings also grew at a solid pace, with average hourly earnings rising 4.3% and weekly earnings by 3.7%.

Inflation

Inflation eased gradually through the course of the year—CPI inflation fell from 6.4% in January to 3.4% in December, although this was a slight pick-up from the low of 3.1% in November. Moreover, personal consumption expenditure (PCE) inflation, the Fed’s preferred gauge, fell from 5.5% in January to 2.6% in December.

Interest Rates

The Fed continued its tightening cycle early in the year, raising its target policy rate by 25 basis points (bps) in each of February, March, May, and July. While it has paused rate rises since July, the Federal Funds Rate ended the year in a range of 5.25-5.5%, the highest level since 2001. This has fed into higher mortgage borrowing costs—the 30-year fixed rate was around 6.6% at year-end, from below 3% as recently as 2021. Capital spending slowed significantly in 2023, growing 0.5%, dragged down by a 10.7% decline in residential fixed investment.

Construction Materials

High construction material and labor costs have been a key theme since the end of the pandemic. On a more positive note, for the construction sector, material input costs mostly fell in 2023. Construction input costs, excluding capital, labor, and imports, fell 1.3% in 2023 following double-digit rises in 2021 and 2022, although the index returned to inflation in December 2023. Likewise, construction material costs, a less comprehensive input cost index, fell 2.8% in 2023 after strong increases in the previous two years.

Generally, lumber, metals, and energy costs were deflationary last year, although concrete and cement costs continued to grow. Construction output costs also slowed through the course of 2023, from 16.8% in January to 0.5% in December. Output prices generally lag input costs as it takes time for firms to adjust prices in response to rising input costs and underlying demand conditions. Construction labor cost inflation outpaced the economy as a whole, and job openings were near record levels for most of the year, suggesting that labor shortages remained a constraint in the sector.

Construction Starts

Total construction starts fell 4.9% in 2023 to a value of $917 billion. However, this followed two years of double-digit growth in 2021 and 2022, leaving total new construction 10.5% above its pre-pandemic level in 2019.

2023 was another strong year for megaprojects valued at $1 billion or more. There were 41 such projects last year for a total value of $103.9 billion, similar to the total value of $103.2 billion for 31 megaprojects in 2022.

Engineering was the only subsector to show growth in starts last year. Total engineering starts grew 13.3% in 2023 with all sectors bar bridge construction and power infrastructure growing at a double-digit pace.

The miscellaneous civil sector led the pack, growing 92%. This segment includes oil and gas projects and was boosted by a $3 billion oil project in Alaska in Q1 and a $3 billion pipeline project in Texas in Q3.

New power infrastructure declined 5.1% in 2023, but that came after an 84.4% increase in 2022 as groundbreaking started on several megaprojects, including a $4.5 billion transmission cable from Canada to New York. Power infrastructure remains a strategic sector for green investment, and there were a number of megaprojects started in 2023, including a new plant in Texas, a solar project in California, and transmission lines in Wyoming and New Mexico.

The 11.6% decline in bridge building resulted from bridge projects in New York and New Jersey started in 2022 falling out of the annual calculation.

Non-residential building starts fell 1.5%, having increased nearly 50% in 2022. Some of the largest declines in 2023 were in the medical segments of hospitals, nursing homes, and miscellaneous medical.

Medical starts had grown 37.2% last year, boosted by a number of megaprojects in the hospital segment. While there was one mega-hospital project in 2023, this was not sufficient to prevent a decline in the sector.

On a more positive note, colleges and universities, courthouses, prisons, and military construction all posted growth of more than 45%. New prison construction, in particular, was the best performing category in 2023, growing 140%, after a $1.6 billion project in New York in Q3 and a $973 million project in Alabama in Q4. Private office building has turned around from its extreme weakness in 2020 and 2021 thanks to several large data center projects that are categorized in this sector, but it remains 27.1% below its previous peak in 2019.

New industrial construction has been the big story over the last two years. Multi-billion-dollar projects in energy, semiconductor fabs, and electric vehicle factories have driven total new construction to record levels. Factory building received a boost in 2022 from the passage of the Inflation Reduction Act and CHIPS Act, and it grew a staggering 229% in that year. While it did fall back by 16.4% last year as several large projects dropped out of the annual calculation, there was no shortage of megaprojects.

Megaprojects

Projects estimated with a value of $1 billion and over, megaprojects, included a Q1 2023 groundbreaking on a $10.5 billion LNG terminal in Texas, and two semiconductor fabs valued at $7 billion each were started in Q4, one in Utah and one in Idaho. Declines in new factory building over the forecast period are not a sign of fundamental weakness, but instead the result of the sector’s surge in the previous year—the level of new industrial construction remains near record highs.

Housing

After initially leading construction following the pandemic, residential starts fell sharply in 2023, down 18.3%. Housing is among the most sensitive sectors to rising interest rates. The rise in mortgage rates over the last year, combined with ongoing affordability issues, has weighed on new single-family construction, which fell 9.8% in 2023. New apartment building fell by an even sharper 31.1%. The commercial real estate firms that own large apartment buildings are particularly sensitive to rising financing costs, and concerns around oversupply in apartments and rising rental vacancy rates weighed heavily on new multi-family construction in 2023.

Regional Construction Starts

On a regional basis, construction starts fell in all major regions except the West. While the South led other regions in terms of economic and population growth, it was also home to several large megaprojects in 2022 in Texas and Louisiana in particular—regional starts had grown by over 30% in 2022. Both the Northeast and Midwest had also posted double-digit growth in 2022, so combined with weaker economic and population outturns compared to the other regions, it was unsurprising that new construction declined. The West had the lowest growth rate in 2022 and was also the location of a number of megaprojects in 2023, including the two previously mentioned semiconductor fabs in Q4 and several power and transmission projects.

The Canadian Year in Review

Canadian GDP is estimated to have grown 1% in 2023 with data through Q3, underpinned by growth in consumer spending. While growth surprised to the upside early in the year, GDP is estimated to have fallen in the final two quarters of 2023. The house price correction that began in earnest in 2022 continued through 2023, and by the end of the year, house prices were 14% below their peak with another two quarters of house price correction pencilled in for early 2024. As a result, residential fixed investment contracted at a double-digit pace for the second consecutive year.

Inflation and Interest Rates

Like in the US, headline inflation gradually cooled throughout the year, falling from 6.3% in December 2022 to 3.1% in November 2023, although it ticked up slightly to 3.4% in December 2023. In January 2023, the Bank of Canada (BoC) increased its benchmark rate by 25bps to 4.5%. It held steady on further rate rises until June, when it raised interest rates a further 25bps in both its June and July meetings. Since July, the BoC has kept the benchmark rate at 5.0%. Mortgage interest rates have increased sharply in response—in December, a five-year fixed averaged 6.4%, up from 5.9% in the same month in the previous year and 3.2% in mid-2021.

Canadian Construction Starts

Total Canadian construction starts rose 5.8% in 2023. Both new non-residential building and civil engineering increased, by 15.4% and 16.2% respectively. New residential starts, by contrast, fell 12.7%, as rising interest rates and the ongoing house price correction weighed on new housing construction. Both single-family and multi-family starts declined for the second consecutive year in 2023, by 23.9% and 3.3% respectively.

Within the non-residential building segment, there were huge variations in new construction activity in 2023. New hotel construction posted the strongest growth of 380%, although it was at a particularly low level during the pandemic and its immediate aftermath. Even after such a strong increase, it was still 6.2% below its 2019 level. New hospital building also increased strongly, up 104.2%. The sector posted three megaprojects over C$1 billion in 2023 in Quebec, Ontario, and British Columbia. Hospital construction was by far the biggest non-residential sector in 2023, accounting for 43% of all non-residential building starts.

On the downside, sectors including private and government office building, shopping and retail, miscellaneous retail, miscellaneous medical, and transportation terminals all fell by more than 50%. In 2022, all of these sectors except private office building had posted either triple-digit growth or near triple-digit growth in the case of retail stores. Private office construction remains structurally weak due to changing post-pandemic work patterns and is now 94% below its 2019 peak.

New construction of civil engineering projects grew in all sectors in 2023 except for dams, canals, marine work, and water and sewage treatment. Bridges and miscellaneous civil engineering posted the strongest growth, at just over 60% in both sectors. Bridge construction was boosted by a C$2 billion project in Quebec in Q2. Miscellaneous civil engineering fell every year from 2020 to 2022, but a $6.8 billion pipeline project in British Columbia returned the sector to growth in 2023. Several new energy projects are in the pipeline, so we expect the sector to grow strongly over the forecast period.

Oxford Economics is the world’s foremost independent economic advisory firm. Covering over 200 countries, over 150 industrial sectors, and 8,000 cities and regions, they provide insights and solutions that enable clients to make intelligent and responsible strategic business decisions faster in an increasingly complex and uncertain world.

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

Alex Carrick served as Chief Economist at ConstructConnect for over 39 years. He retired in 2024.

ConstructConnect leading provider software solutions for the construction industry releases the US Construction Put-in-Place Forecast of...

ConstructConnect leading provider of software solutions for the preconstruction industry releases the Autumn 2024 Construction Starts Forecast

ConstructConnect a leading provider of software solutions for the preconstruction industry releases the quarterly US and Canada Construction Starts...

ConstructConnect leading provider of software solutions for preconstruction industry announced US construction to grow at 4.5% in Spring 2024...