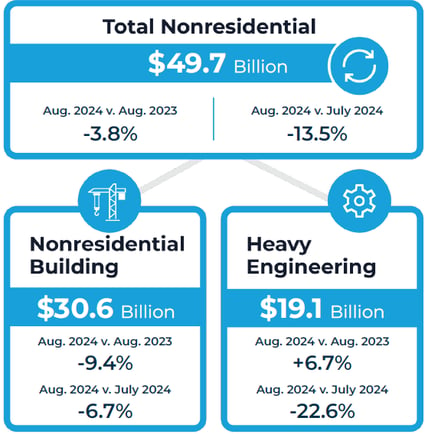

ConstructConnect reported today in the Construction Economy Snapshot that the August 2024 volume of Total Nonresidential construction starts—the sum of Nonresidential Building and Heavy Engineering—was $49.7 billion, a decrease of $7.8 billion, down 13.5% from a revised July reading of $57.5 billion.

Grand Total construction starts spending, which includes total nonresidential and residential construction, was $69.5 billion, down 2.4% year-to-date through August.

Nonresidential Building Total Offset by Heavy Engineering

In the Nonresidential Building category, which includes commercial, industrial, and institutional construction, year-to-date starts totaled $247.8 billion through August, down 9.4% from the comparable period of a year ago. In dollar terms, nonresidential building construction is nearly $24 billion behind where it was at this time in 2023.

Chief Economist Michael Guckes, the report's author, explained that year-to-date results would be worse without the contribution of the heavy engineering segment. Guckes writes, "Engineering activity has helped to offset a near 10% contraction in nonresidential building activity in the year period through August."

Guckes noted that several nonresidential subcategories are contributing to the year’s spending shortfall. Manufacturing and warehousing have pulled spending down the most, with a combined gap of nearly $19 billion compared to the first eight months of 2023. Guckes cautions that this is more of a special situation than representative of other stumbling categories. Manufacturing spending, he said, is normalizing after a 2022-2023 surge.

On Interest Rates

Commenting on interest rates, Guckes said he's looking at "residential spending to provide early indications of a greater construction spending rebound."

Following the US central bank’s announcement this week to cut interest rates, Guckes said, “This latest aggressive cut should be welcomed news to the construction industry given its reliance on debt to finance construction.”

Read the Construction Economy Snapshot for more details, including trend graphs, analysis, and commentary.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.