In short:

- AI-driven data centers now dominate office construction and spur infrastructure work.

- Nonresidential put-in-place spending grows, rewarding diversified, data-informed market strategies.

- Construction costs outpace bids, demanding tighter cost tracking and disciplined bidding.

The U.S. construction market is growing in 2026, but new trends are changing what is being built and where, as well as how much work costs. That’s according to ConstructConnect Chief Economist Michael Guckes and Dr. Nicholas Fearnley, Head of Global Construction Forecasting at Oxford Economics, who presented their findings during a recent live event called Where Does the U.S. Construction Economy Go from Here?.

“We do think that the U.S. is going to continue to grow strongly and also outperform other advanced economies [this year],” Dr. Fearnley told attendees. “This U.S. exceptionalism is really being driven by productivity gains we’re not seeing in other parts of the world.”

So, what’s behind this belief? It’s one of the three big shifts we’re seeing in the construction industry right now.

Shift #1: Data Centers (and A.I.) are Driving Construction

It’s probably no secret to anyone in construction that there is a boom in the building of data centers to support the growing usage of artificial intelligence (AI). In the U.S., data centers fall under the category of “offices,” which has created an interesting trend.

“We've seen that data centers are accounting now for around half of office construction activity, and we do expect activity will continue to boom over the coming years as we build a lot more of these,” Fearnley told the audience.

But that doesn’t necessarily mean that every contractor and tradesperson should pivot their focus to just data centers. These facilities also require a lot of power and cooling to operate. That means as the demand for data centers increases, so does the need for new work in power plants, water systems, and other infrastructure.

Shift #2: Pay Attention to Put-in-Place Spending Forecasts

Guckes says put-in-place spending, or the value of work actually installed, is also set to grow in the U.S. this year. After a small drop in 2025, total nonresidential put-in-place spending is expected to move toward $1.3 trillion in 2026 and near $1.4 trillion in 2027.

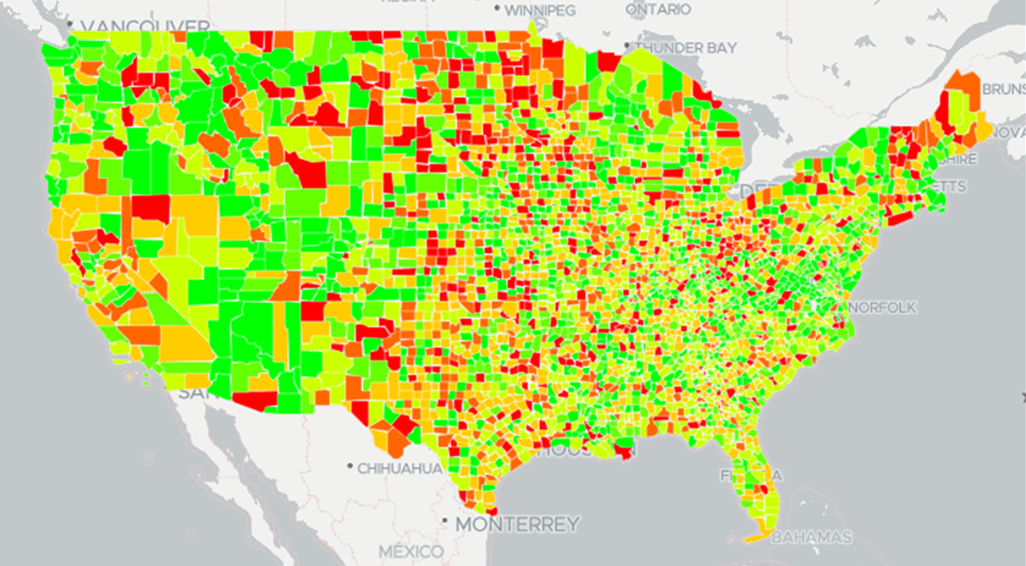

.png?width=1154&height=569&name=2026%20US%20Construction%20Activity%20Map%20(5%20Year%20Outlook).png)

Private work is growing faster than public work, and commercial and manufacturing are key bright spots in ConstructConnect and Oxford Economics’ current put-in-place projections.

Guckes gives a clear recommendation to businesses regarding following these trends.

"We constantly recommend that firms have a diversification strategy when it comes to your revenue strategy, making sure that you're not putting all of your sales and marketing efforts into just one vertical or one subcategory or two subcategories, but really trying to think broadly about the industry so that when the when it becomes clear that a certain segment of the industry is growing very quickly, you can adapt your business model to that industry that's growing more aggressively," he said.

How Can Construction Professionals Stay on top of Put-In-Place Spending?

To help businesses diversify their strategies, ConstructConnect provides a full five-year view of U.S. construction spending with the U.S. Construction Put-In-Place Forecast.

“Get below the headline numbers. Don't just look at the aggregate data,” Guckes cautions. “You really need to be looking at what's happening at the subcategory level, along with the geographic regions that impact you, whether that's state or city level.”

Built in partnership with Oxford Economics, the forecasts offer data down to national, state, county, and city levels, giving construction professionals, contractors, manufacturers, and suppliers the foresight to invest, staff, and stock with greater confidence.

You can find more information on U.S. Construction Put-In-Place Forecasts, and sign up for a forecast strategy call, on this page.

Shift #3: Construction Costs are Rising Higher than Bids

Labor is tight, tariffs on materials like steel and lumber are higher, and many firms are feeling margin pressure. To stay ahead, Guckes and Fearnley say general contractors, tradespeople, and owners need to track costs closely, use smart contracts, and stay flexible about which sectors they chase.

“I'd say looking for collaborative strategies. So, sort of working together to share risk, maybe considering some escalation clauses to account for risks around material increases [could help],” Fearnley said before also suggesting, “And planning ahead: Knowing where work's going to be, trying to plan ahead for your labor force, maybe locking things in earlier—more at the preconstruction phase instead of the financial close stage. And locking in subcontractors where you can.”

Guckes agrees and added that it’s also important for businesses to be “ruthless” in their bid discipline.

“I think we need to make sure that as construction industry leaders, we need to be very careful and very thoughtful about how we bid. We don't want to create bids that we can't recover from and bids that end up resulting in either very little little profit or maybe even no profit at all,” he cautioned.

For a deeper, data-heavy look at put-in-place trends, tariffs, and mega projects, read our full ConstructConnect News article: AI, Data Centers, and Tariffs Define the 2026 Put-in-Place Outlook.