Tips from an expert architect: 5 strategies to start right now

Get tips from Derek Guffey, building proudct manufacturer sales expert and former architect, on increasing product specification for manufacturers.

One-on-One with Doug Bevill, Vice President, Manufacturer Solutions at ConstructConnect™

Stinging supply-chain woes ripple through the global economy with the reach and tenacity of a world-class boxing champion. Building product manufacturers looking to land a one-two counter punch have a champion of their own in ConstructConnect’s Doug Bevill. With over 30 years of industry experience, Doug specializes in consulting with BPMs on general strategy and optimal ways to leverage ConstructConnect’s best-in-class construction information and other marketing solutions to run and grow their businesses.

Before joining ConstructConnect, Doug spent 18 years at McGraw-Hill Construction and has held executive positions as Director of Marketing for FläktGroup, a leading manufacturer on energy recovery technology; Chief Operating Officer for The Hager Companies, a global door hardware manufacturer; and is the past President and CEO of BIMobject Inc., a global construction technology company.

Before joining ConstructConnect, Doug spent 18 years at McGraw-Hill Construction and has held executive positions as Director of Marketing for FläktGroup, a leading manufacturer on energy recovery technology; Chief Operating Officer for The Hager Companies, a global door hardware manufacturer; and is the past President and CEO of BIMobject Inc., a global construction technology company.

Doug recently sat down with me to discuss the systemic supply chain issues challenging the construction industry and how BPMs might adapt for improved performance.

Marshall Benveniste (MB): What are some of the supply chain issues BPMs are facing?

Doug Bevill (DB): It’s tough for BPMs used to hitting the mark on delivery schedules to face supply-side issues while demand is mainly robust. We’ve seen rising material prices, transportation costs jump, and labor issues affect the supply of input materials and consequently the final goods.

For most BPMs currently, sales or orders received are not the problems. Demand for building products is high, even to the point that they are outpacing the ability of some BPMs to meet demand. Most of the economy is relatively healthy from a demand perspective, but there is a supply shortage, leading to higher inflation.

Plus, there are many other things at work pressuring profits and snagging up supply. Rising offshore labor costs compounded by tariffs, global politics, the lingering effects of the pandemic, and ongoing domestic labor challenges. I could go on … maintaining a reliable workforce due to COVID-19 infections, government-subsidized pay, demand for higher wages and work conditions, and “The Great Resignation.” The conglomeration of variables has created challenges for BPMs to get pieces needed to assemble a complete product and finished goods from their factories and distribution centers for customer delivery.

MB: How do BPMs identify new opportunities and forge new relationships given the state of the supply chain, particularly considering price increases and customers’ pain points like delayed delivery?

DB: In the here and now, BPMs are largely married to their current supply chain strategy, which after China received permanent most-favored-nation trading status in September of 2000, many BPMs, like other types of manufacturers, started moving parts and pieces, and even entire finished goods production to China and other countries where labor rates were favorable. In the future, a complete review of a BPM’s supply chain strategy will be critical to meet future customer demand.

MB: Looking at BPMs production side, what recommendations do you have to boost production efficiency?

DB: Before the COVID-19 pandemic, the political environment in the Pacific Rim was already going to put BPMs at risk. It escalated when the United States decided to place tariffs on goods coming from China and other countries. BPMs that were getting all, or part of their finished goods from targeted countries, either had to pass these increased costs on or take lower margins. My recommendation would be to reevaluate their make-or-buy strategy and consider recapitalizing in North America or partner with North American manufacturing sources for a more reliable and predictable supply chain.

MB: Where can manufacturers turn to get actionable insights to help manage their supply chain pressures?

DB: Many places provide experts who can offer a BPM many perspectives. BPMs that are not already in the practice of sales and operations planning should start doing so. The process of S&OP is simple once the necessary components are in place. The idea is to have the company’s supply, demand, and financial planning synced so leaders can execute the optimum strategic and tactical decisions.

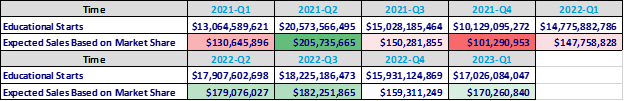

Sales and operations planning can be analyzed quantitatively in various valuable ways with industry metrics. For example, we could use monthly construction starts, product market share, and expected sales.

Here’s an example of sales and operations planning I worked out. I pegged a market share based on sales in U.S. dollars, exemplifying educational construction starts from ConstructConnect’s Forecast software, which delivers a current and future sales forecast. It’s a very revealing and insightful way to manage. Therefore, construction starts can be helpful to BPMs in planning production and inventory level in the S&OP process.

S&OP typically calculates on a rolling 90-day increment, but companies can do it as frequently as needed.

MB: Looking past the option for price increases, what are some ways BPMs can maximize profits with supply issues and inflation present?

DB: There are a few ways to maintain or maximize profits in any business environment. One is to lower operational costs where corporate discipline identifies them as excessive or unnecessary. Selling, general, and administrative expenses are, in most cases, a good place to trim for short, medium, and long-term efficiency.

Another way is to set pricing according to market conditions. A manufacturer could perform a detailed price analysis by Stock Keeping Unit. Then apply some select pricing strategies. If the competition has raised prices, this is an opportune time to stand pat and increase market share and volume, which for manufactured goods will, in most cases, lower overhead, which leads to increased earnings before interest, taxes, depreciation, and amortization.

But with sourced goods, it will be necessary to increase prices to maintain profit, or EBITDA goals, since they do not consume much overhead.

Finally, keep your vendors honest. They are in the same boat as you and will attempt to raise prices, tag on surcharges, and perhaps even reduce service levels. In the end, we are all on this journey together, so help your vendor partners where it makes good mutual business sense but don't get exploited.

MB: Discuss your perspective on monitoring market performance and how to determine if a particular supply chain strategy is working? What data are valuable to BPMs in this environment?

DB: In my mind, especially as we advance, manufacturers should be using a few different processes to formulate their make-or-buy decisions, other than a standard cost model, which can lead to inaccurate results in determining what it costs to make a product.

Activity-based costing is a much more accurate and effective way to determine the real labor and material value that goes into a product instead of a stand-alone cost allocation based on volume. Standard cost accounting is acceptable for finance. However, if a manufacturer relies solely on standard costs in the make-or-buy process, they risk increasing plant overhead. Sourcing certain products over making them can impact EBITDA growth goals.

MB: What is the long-term outlook for BPMs that adapt, learn, and evolve with supply chain challenges?

DB: Right now, the world is in a dynamic state of flux; with the aforementioned political environment in the Pacific Rim and Russia’s invasion of Ukraine, there will be further price and supply challenges. These circumstances are in conjunction with the onset of tariffs in 2018, China’s takeover of Hong Kong, and their more adversarial stance toward the West. Maintaining a supply chain stance dependent on stable foreign political environments is very risky.

In the end, the COVID-19 pandemic uncovered the risks that were always there in the offshoring of products. As the virus issues lessen, manufacturers and labor will come together shortly after, leaving the giant elephant in the room—the risk of rising offshore labor and changing political challenges.

MB: Doug, thank you for joining me today and sharing your insights and perspectives.

DB: Thank you, Marshall. It has been my pleasure.

Contact us today for more information about ConstructConnect solutions for Building Product Manufacturers, Specpoint – Powered by AIA MasterSpec and Insight.

Marshall Benveniste is the Managing Editor of ConstructConnect News and also serves as the Senior Content Marketing Manager with ConstructConnect’s Economics Group. He oversees editorial coverage of U.S. nonresidential construction and the construction economy. Before joining ConstructConnect in 2021, Marshall spent 15 years developing marketing communications strategies for financial services and specialty construction firms. He holds a Ph.D. in Organizational Management.

Get tips from Derek Guffey, building proudct manufacturer sales expert and former architect, on increasing product specification for manufacturers.

Check out these four tips to build relationships between contractors and building material suppliers, distributors, and building product...

How Building Product Manufacturers Can Benefit From Augmented Reality

Learn why competitive tracking is crucial for building product manufacturers, with insights from industry expert Dale Draggoo on making smarter...