See the World's First 3D Printed Excavator in Action

See the World's First 3D Printed Excavator in Action

Midway through 2025, here’s the outlook for the construction economy in North America.

In short:

The construction economy in the U.S. and Canada is facing some tough challenges as we head toward the middle of 2025. Experts are hopeful for improvement, but the industry is dealing with slow growth, labor shortages, and different trends across regions.

The good news? ConstructConnect Chief Economist Michael Guckes says, “While things are volatile now, they will not be volatile forever."

Here’s a look at what’s happening right now, thanks to the research of leading economists in construction.

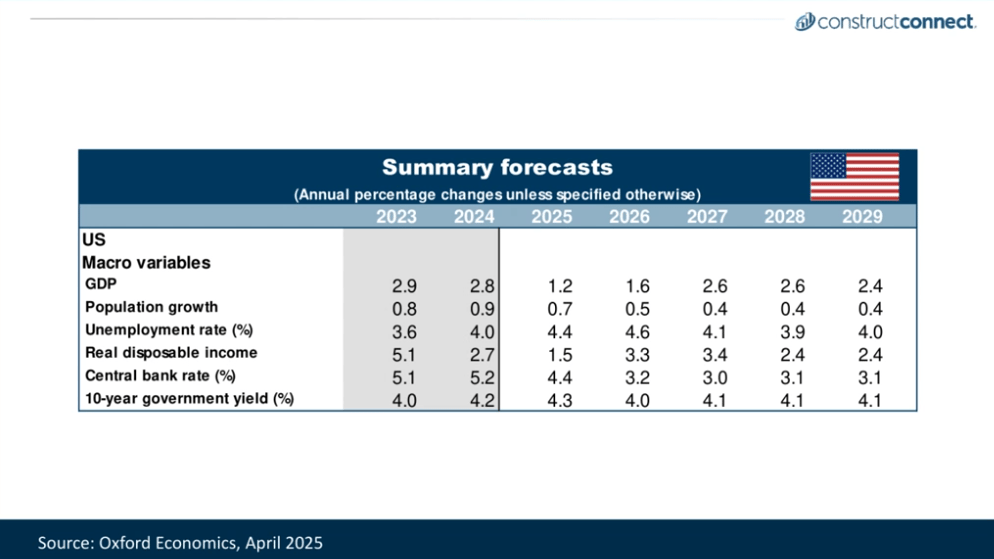

The overall economy remains uncertain, with only small signs of growth.

Overall:

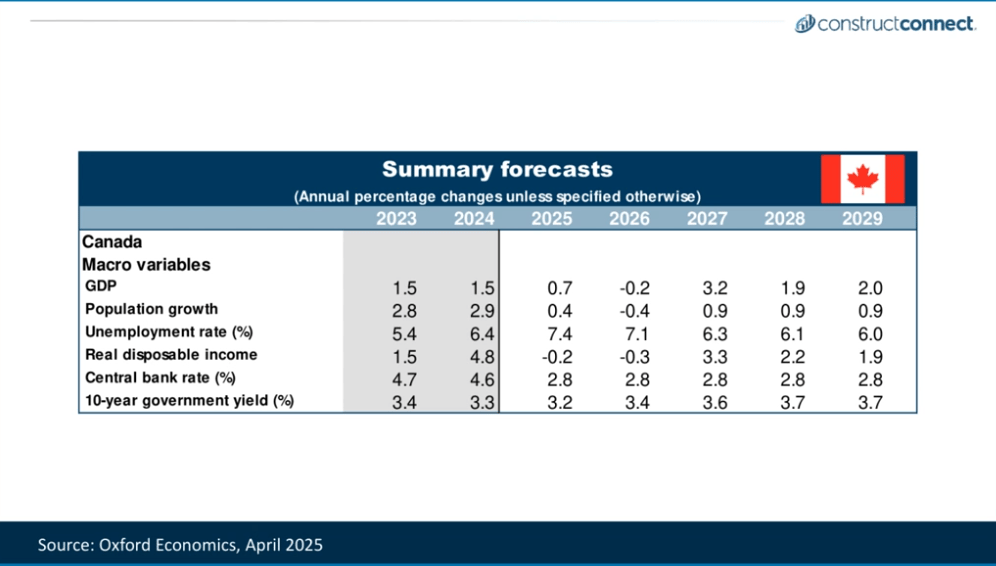

Canada’s economy shows mixed results. Alberta is struggling, where construction starts are down nearly 50% compared to last year, but the Atlantic provinces (New Brunswick, Newfoundland and Labrador, and Prince Edward Island) saw a near 170% jump in starts. Such a mix shows how much construction trends can vary widely across regions.

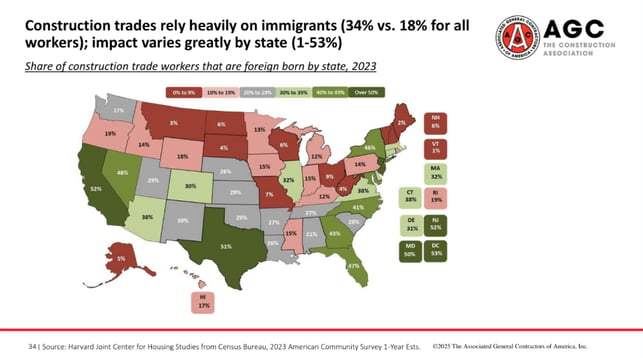

Finding workers is still a big issue for construction. Wage demands and new immigration policies in the U.S. are making things even harder. Guckes points out, “Construction is disproportionately more dependent on foreign labor than a lot of our peer industries.”

Here are some key takeaways:

Ken Simonson, Chief Economist at the Association of General Contractors, explains, “Firms are not only not hiring right now, they’re not even looking to hire at the extent that they had been.” He predicts, “[Firms] still expect a pickup [in construction activity] in the near future, and that’s why they’re hanging on to the workers they have.”

Labor shortages make immigration policy an important issue for construction. Guckes predicts competition for labor will grow, both inside and outside of construction. Kermit Baker, Chief Economist for the American Institute of Architects, agrees. He says, “Immigration has taken a back seat with the focus on tariffs, but the immigration policy is likely to pick up momentum.”

Guckes adds, “[When] it comes to the battle for labor and competing for labor, we not only are going to see a lot of intra-competition—construction firms trying to steal from construction firms' quality labor—but we're also going to see a lot of outside demand for those same laborers because there are just so many firms that will be desperate to find people to do necessary jobs. And we saw that, of course, during COVID.”

We will have to keep a close eye on this aspect as 2025 continues.

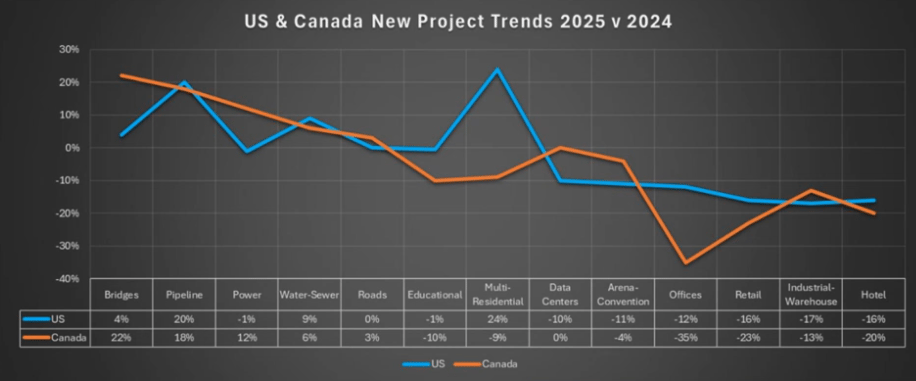

Not all areas of the construction industry are struggling. Fonda Rosenfeldt, Vice President of Content Acquisition for ConstructConnect says, “Public spending right now is driving activity. Private work is cautious but growing.”

Here’s a closer look at bidding activity and where the growth is happening:

Speaking on megaprojects, Rosenfeldt says, “Will they be leading construction spending this year, with so many of them starting? Those are all things to be seen.”

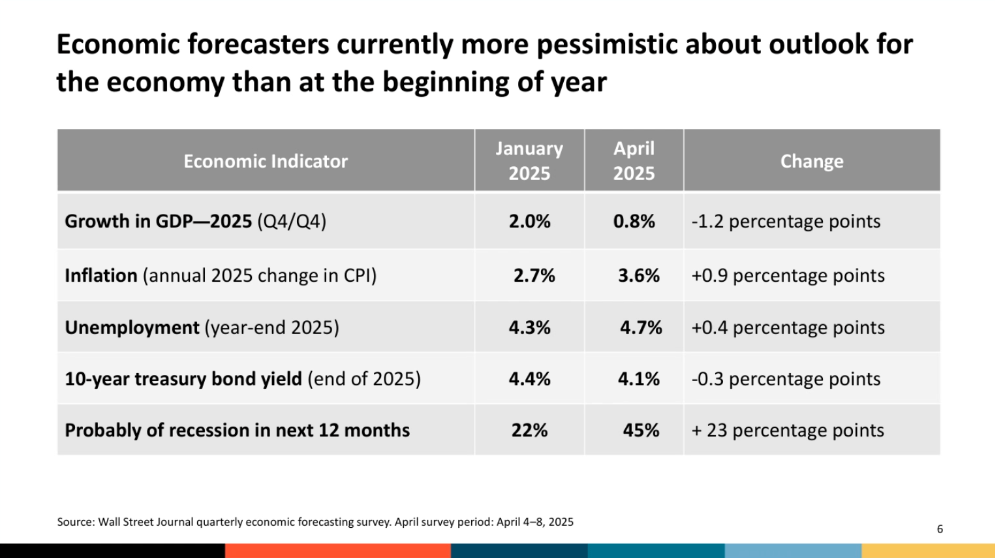

The economy adds more pressure to the construction industry. Inflation is increasing, unemployment is expected to go up, and the chance of a recession has doubled since January.

Tariffs, and their effect on the prices of construction materials, are another concern. While nothing is for certain, Baker remains optimistic.

He says, “We’re probably at, or near, what I would call ‘peak tariff levels’ now, as the Trump administration seems to be backing off their use of tariffs to achieve policy goals, or at least stabilizing them to some extent.”

The construction industry is in a challenging spot right now. Growth is slow, but there are opportunities, especially in civil projects and large-scale megaprojects. Public spending is helping boost activity, while private investments remain cautious.

Labor shortages are the biggest challenge, as construction companies struggle to find skilled workers. Even so, record-low layoffs suggest a hopeful outlook for the future. The second half of 2025 will be crucial in shaping where the industry goes from here.

Looking for more insight?

Johnny Bradigan is a Senior Content Marketing Manager at ConstructConnect®, specializing in customer communications, newsletters, product launches, and thought leadership contributions. His work often focuses on ConstructConnect’s solutions for building product manufacturers and takeoff products, including On-Screen Takeoff®, PlanSwift®, and Quote Soft®. With over 15 years of experience in marketing, corporate communications, journalism, and leadership development, Johnny has a diverse background covering everything from breaking national news stories to educational blog posts.

See the World's First 3D Printed Excavator in Action

3 Ways Preliminary Notices Build Better Relationships With the General Contractor

The Path to Green & Sustainable Construction

3D printing is showing promise for the future of the construction industry, but we should recognize the benefits it's bringing to our current needs.