November’s inflation data reported on December 13, 2022, came in below expectations. The basket of goods and services, which are used to broadly track prices, rose 7.1% in the year period ending November. This latest year-on-year rate change is the lowest since prices first began their rapid ascent in early 2021. Furthermore, it marks the fifth consecutive decline in annualized inflation rate readings since June 2022’s decades-high reading of 9.06%.

In short, this broad index of prices continues to increase through present, but at a slower pace than earlier in 2022 and late 2021. Importantly, this week’s reading should not be understood as a signal of declining prices. Nevertheless, falling inflation rates give economists, including those at the Federal Reserve, some confidence that the economy is moving toward a more stable supply and demand equilibrium after two years of shocks.

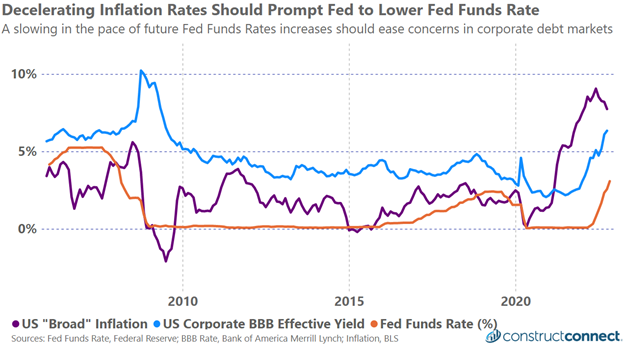

It should be noted, however, that Federal Reserve actions have less of an impact on corporate and consumer interest loan rates than is generally described. The past 20 years of history illustrate a much stronger, albeit certainly not perfect, correlation between the rate of inflation and loan rates as compared to the federal funds rate and loan rates.

In response to the Great Recession of 2007 through 2009, the Federal Reserve lowered the FFR to near 0% and held it there for most of a decade while at the same time, loan and inflation rates both fluctuated by several percentage points, often directionally trending together. This brief historical review of the data should make borrowers optimistic that the trending decline in the inflation rate, especially if sustained, will result in a plateau in interest rates and even an eventual decline.

A second reason to believe that inflation is in the early stages of settling comes from a 2022 study released by the Federal Reserve, which determined that the single largest cause of surging inflation over the last two years was excessive government spending, much of which manifested itself in the form of stimulus transfer payments to citizens.

The issue was made worse by regulations that restricted production activity. The combination of these factors ultimately resulted in too many dollars chasing too few goods. Federal Reserve researchers determined that 3% of inflation post-COVID-19—approximately half of the core inflation rate of 6%—was the result of excessive U.S. and other foreign government emergency spending.

As emergency spending measures continue to give way to more sustainable fiscal practices in 2022 and beyond, the flow of dollars in both the U.S. and global economy should normalize and, with it, inflation. Here again, the resulting decline in inflation will allow the Federal Reserve to lower its reserve rate more confidently and, in doing so, hopefully quickens the decline in borrowing costs lower for corporations and individuals.