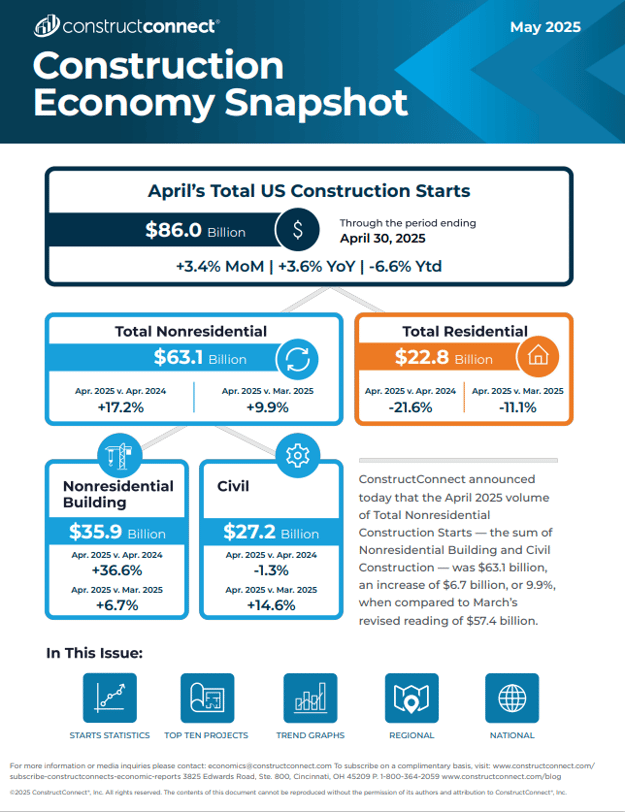

- April 2025 Nonresidential Construction Starts were $63.1 billion, a 9.9% increase over March, and the first time that monthly starts surpassed $60 billion this year.

-

According to Chief Economist Michael Guckes, megaprojects were a major driver, contributing over $15 billion to April’s total.

-

Widespread gains in civil construction and key nonresidential building categories helped reduce the year-to-date decline in overall nonresidential spending to just 0.5%.

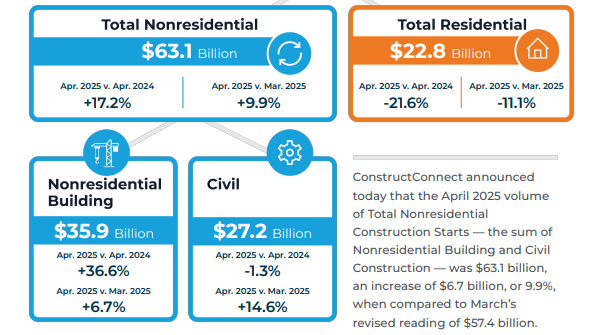

ConstructConnect announced today that the April 2025 volume of Total Nonresidential Construction Starts — the sum of Nonresidential Building and Civil Construction — was $63.1 billion, an increase of $6.7 billion, or 9.9%, when compared to March’s revised reading of $57.4 billion.

Monthly Nonresidential Starts exceeded $60 billion for the first time in 2025. Ten megaprojects contributed over $15 billion to the month’s total starts spending.

Megaprojects Ride to the Rescue of Nonresidential Building

Chief Economist Michael Guckes said, “Consecutive months of strong megaproject activity has now lifted the monthly average spending on megaprojects to $9.9 billion, up from $8.4 billion in February.”

Michael Guckes, Chief Economist, ConstructConnect

There were seven commercial or institutional megaprojects in April, providing a much-needed boost to nonresidential building activity, Guckes reported.

The April results included five commercial projects worth a collective $7.9 billion and two institutional projects worth $2.8 billion.

Summary chart of Total Nonresidential and Total Residential volume of April 2025, US Construction Starts. Image: ConstructConnect Construction Economy Snapshot

Highlights by Subcategory

Many subcategories within Civil construction continue to report strong gains year-to-date (YTD), including Airports, Electric Power Infrastructure, Dam/Marine, and Bridges.

Additionally, thanks to April’s strong results, Guckes said several nonresidential building categories are now positive YTD. These include Sports Stadiums/Convention Centers, Private Offices (including Data Centers), Nursing/Assisted Living, and Colleges and Universities.

Nonresidential spending improved substantially based on revised March data and solid April results.

- March’s original YTD nonresidential starts were reported down 9.6%, yet the revised figure now puts that decline at just 6.7%.

- Guckes said that April’s nonresidential reading then lifted YTD spending further, allowing for a mere 0.5% contraction.

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.