KEY POINTS

- Nonresidential construction reached a record $77 billion, led by Industrial and Civil sectors, while Education, Commercial, and Institutional categories showed notable recovery and growth through May.

- 2025 construction trends favor the Northeast, with New England and Mid-Atlantic states posting double-digit growth, while traditional leaders like Texas, Florida, and California face declining spending.

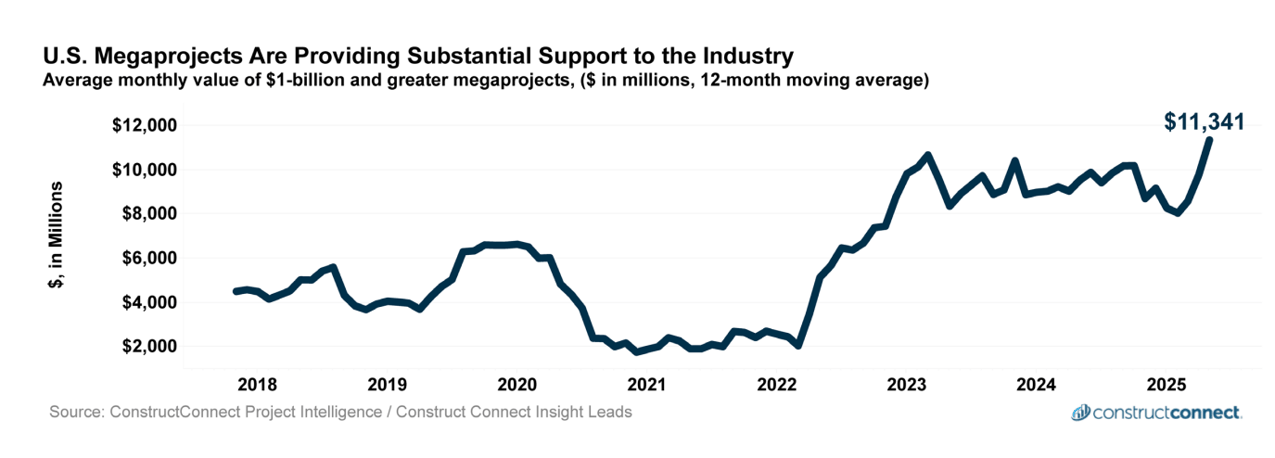

- Megaproject spending in May exceeded $30 billion, with Taiwan Semiconductor’s Phoenix expansion alone driving one-third of total spending.

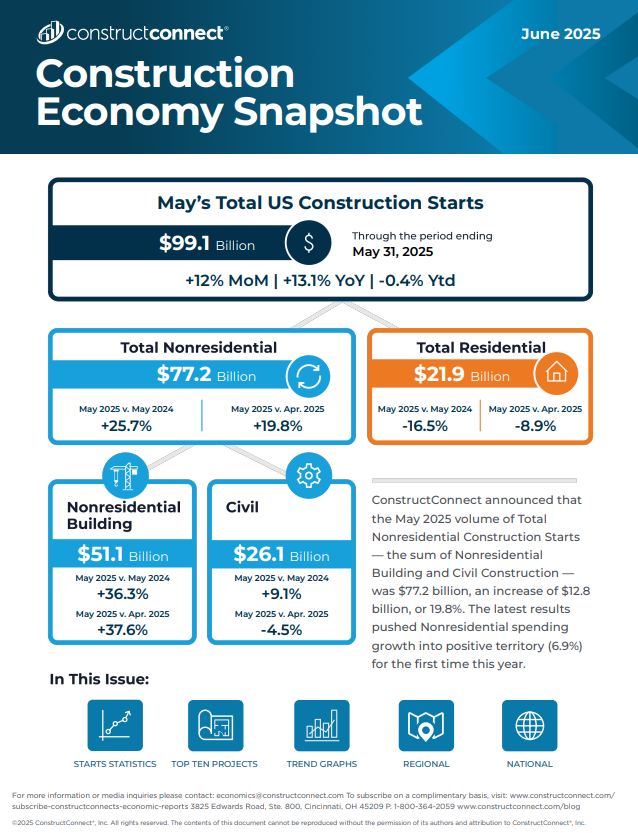

Record-Breaking Nonresidential Construction Driven by Megaprojects

May’s surging level of megaproject construction starts, which topped $30 billion, lifted total year-to-date (YTD) construction spending to within 1% of last year’s level.

These megaprojects accounted for 39% of total nonresidential starts, pushing overall spending to a decades-long record of $77 billion.

A major driver of this surge was Taiwan Semiconductor Manufacturing Company’s phase 3 expansion in Phoenix, AZ, which alone contributed to one-third of total May spending.

This investment will provide immediate and long-term benefits for the U.S. construction economy, particularly by solidifying the Southwest as a global hub for advanced chip development and manufacturing.

May’s surging level of megaproject starts, which topped $30 billion, lifted total YTD construction spending to within 1% of last year’s level. Image: ConstructConnect

Industrial and Civil Construction Lead, Other Segments Show Signs of Recovery

While most megaprojects continue to benefit the Industrial and Civil construction sectors, May’s data also suggests broader industry recovery.

Early in the year, most major construction categories, or “primary categories” like Medical, Commercial, Education, and Institutional, reported contracting spending. However, the latest May data paints a more positive picture:

New Geographical Trends Emerging

Contrary to long-standing geographic trends, 2025 construction activity is growing in unexpected regions. Historically, the Southern and West Coast states led growth due to tech investments and domestic migration.

New England and Mid-Atlantic States Lead the Charge

But year-to-date, the regional spotlight is on:

-

New England: Up 22%

-

Middle Atlantic: Up 7.2%

Top-performing states YTD include:

-

Maine: Up 25%

-

Massachusetts: Up 48%

-

Pennsylvania: Up 43%

-

New Jersey: Up 12%

Historically Dominant States Struggling

In sharp contrast, historically dominant states are experiencing construction spending declines in nonresidential building starts, YTD:

-

California: Down 2%

-

Texas: Down 17%

-

Florida: Down 3%

These three states, which accounted for $200 billion in 2024 (30% of all Nonresidential Building (NRB) spending), are now seeing notable slowdowns.

Other struggling states include:

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.