ConstructConnect Chief Economist Michael Guckes released the U.S. Put-in-Place Construction Forecasts for Summer 2025 today.

The U.S. Construction Put-in-Place Forecast, created in partnership with Oxford Economics, provides a comprehensive five-year outlook for construction.

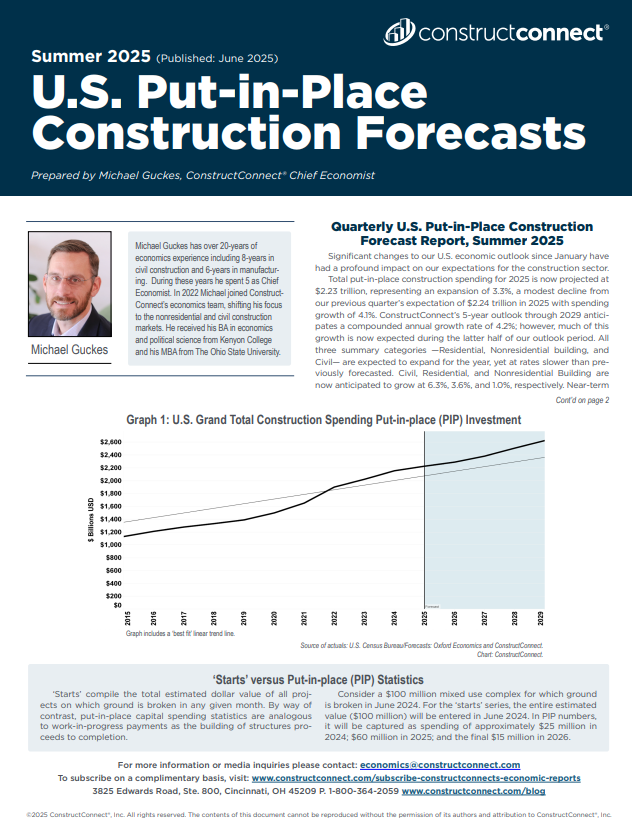

Total put-in-place construction spending for 2025 is now projected at $2.23 trillion, representing an expansion of 3.3%.

This figure is a modest decline from the previous quarter’s expectation of $2.24 trillion in 2025, with spending growth of 4.1%. Put-in-place spending data are comparable to work-in-progress payments as buildings under construction proceed to completion.

Guckes said, “Significant changes to our U.S. economic outlook since January have had a profound impact on our expectations for the construction sector.”

The three primary construction categories—Residential, Nonresidential Building, and Civil—are expected to expand for the year, yet at rates slower than previously forecasted.

Civil, Residential, and Nonresidential building are now anticipated to grow at 6.3%, 3.6%, and 1.0%, respectively.

Guckes added, “ConstructConnect’s 5-year outlook through 2029 anticipates a compounded annual growth rate of 4.2%.”

“However, much of this growth is now expected during the latter half of our outlook period.”

Highlights from the Put-in-Place forecast also include this outlook for the remainder of 2025 through 2029:

Total Nonresidential Construction

(Combines Civil Construction (Heavy Engineering) and Nonresidential Building)

Expected Growth:

-

- 3.1% in 2025

- 2.2% in 2026

Private Offices are expected to grow 5.8% this year (surging data center construction offsets weak office activity).

Leading Private Sector Growth Segments:

-

- Power: 12.1%

- Public Safety: 10.0%

- Lodging: 8.6%

- Transportation: 7.0%

Public Construction is anticipated to experience slowing growth from 3.3% in 2025 to just 0.2% in 2026 before slowly reaccelerating to 2.7% by 2029.

U.S. Grand Total Construction Spending Put-in-place (PIP) Investment in the graph shows forecasts in the shaded section to the right of the vertical line. Image: ConstructConnect

Nonresidential Building (NRB)

NRB is projected to struggle disproportionately under future market conditions:

-

- Contract by 1.7% in 2026.

- Remain almost flat in 2027.

- Growth to exceed 3% only in 2028 and thereafter.

Residential Construction

-

- Near-term headwinds will keep growth sluggish through 2026.

- Growth is expected to pick up to 5.5% in 2027 and 6.2% in 2028.

The ConstructConnect Put-in-Place Construction Forecasts is produced in partnership with Oxford Economics.

Explore the commentary and analysis in the

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.