September's Nonresidential Construction Starts +26% M/M, +19% Y/Y, & +29% YTD

ConstructConnect announced today that July's volume of construction starts, excluding residential work, was $53.7 billion.

ConstructConnect announced today that August 2022’s volume of construction starts, excluding residential work, was $40.0 billion, a decrease of -26.3% compared with July’s figure of $54.3 billion (originally reported as $53.7 billion).

With respect to starts overall, and mega project starts in particular, August found July to be a hard act to follow. July featured five projects with estimated values in excess of $1 billion each, totaling $13.3 billion. August had no such work to crow about. August did, however, have quite a nice string of projects in the hundreds of millions of dollars each.

/industry-snapshot_september.jpg?width=200&name=industry-snapshot_september.jpg)

View this information as an infographic.

Click here to download the complete Construction Industry Snapshot Package - August 2022 PDF.

There are plenty more really big projects in the pipeline. They mainly originate in the auto and energy sectors, with semiconductor capacity expansions and air and rapid transit planned undertakings as an extra bonus. They just haven’t hit the starts yet.

But it also needs saying that there’s a reason to be uncertain about the outlook. The possibility of recession, and the Federal Reserve’s chest thumping about interest rate hikes, to combat an inflation rate that remains stubbornly elevated (+8.3% y/y for CPI-U in August), threaten to cause delays in some big project authorizations.

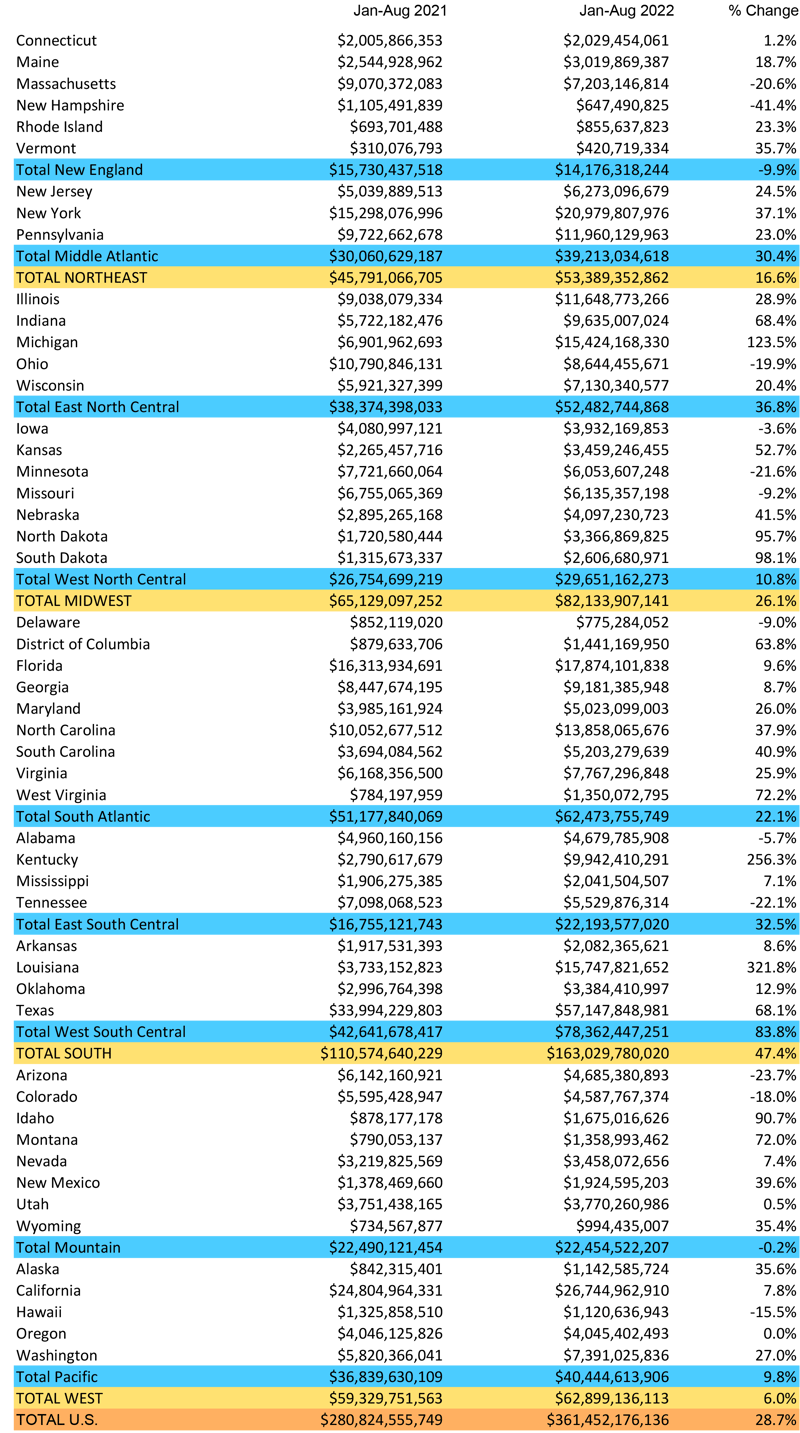

August 2022’s total dollar volume of nonresidential construction starts was up by +9.4% when compared with August 2021. On a year-to-date basis, total nonresidential starts have been +28.7% versus January to August of last year.

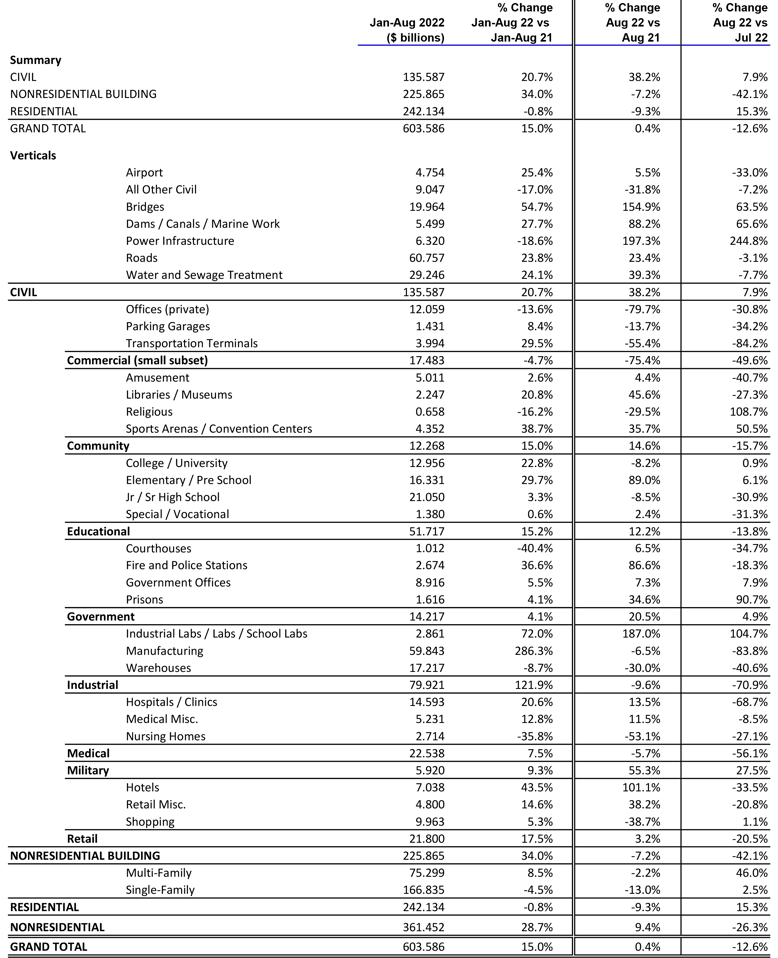

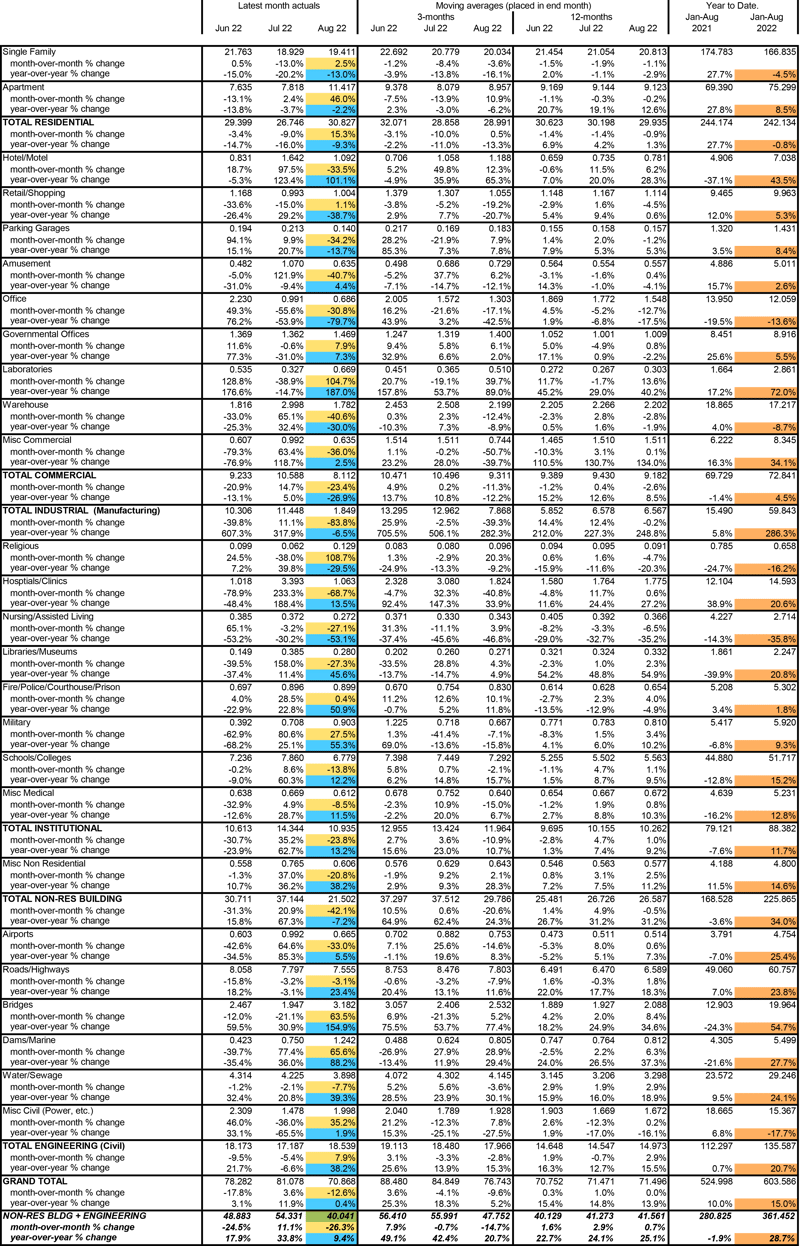

To complete the starts picture, the GRAND TOTAL, i.e., adding residential to nonresidential activity, in August 2022 was -12.6% m/m, +0.4% y/y, and +15.0% YTD.

There are three major subcategories of total starts: residential, nonresidential building, and heavy engineering/civil. On a year-to-date percentage-change basis in August 2022, nonresidential building starts performed best, +34.0%, with engineering also up in solid fashion, +20.7%. Residential stood on the curb, watching the parade go by, -0.8%.

On a month-to-month basis, though, residential made a good showing in August, +15.3%, and engineering also did well, +7.9%. Nonresidential building starts, however, with nothing to replace July’s megaproject lineup, were down steeply, -42.1%.

Other statistics often beloved by analysts are trailing 12-month results and these are set out for all the various type-of-structure categories in Table 10.

Grand Total TTM starts in August 2022 on a month-to-month basis remained flat (0.0%), which was an easing from July’s +1.0% and June’s +0.3%.

On a year-over-year basis in August 2022, Grand Total TTM starts were up by a good amount, +13.9%, although not by quite as much as either July’s +14.8% or June’s +15.4%.

Starts compile the total estimated dollar value and square footage of all projects on which ground is broken in any given month. They lead, by nine months to as much as two years, put-in-place statistics which are analogous to work-in-progress payments as the building of structures proceeds to completion.

PIP numbers cover the universe of construction, new plus all manner of renovation activity, with residential traditionally making up two-fifths (about 40%) of the total and nonresidential, three-fifths (i.e., the bigger portion, at around 60%).

Over the past several years, however, the mix has undergone a massive and startling shift. In 2021’s full-year PIP results, the residential to nonresidential relationship was about half and half. Through July of this present year, 2022, there’s been a flipping of the ratio to the point where residential now claims a 53.0% share of the total, leaving nonresidential with the other 47.0%.

The January-July 2022 over January-July 2021 total dollar volume of PIP construction was +10.8%, with residential robust at +20.3% and nonresidential meek, at +1.7%. In the months ahead, the big disparity in gains will almost certainly narrow. Residential construction activity is notoriously susceptible to shrinkage under a climbing interest rate regime. (Conversely, it receives a big boost when mortgage rates are declining.)

PIP numbers, being more spread out, have smaller peak-over-trough percent-change amplitudes than the starts series. As an additional valuable service for clients and powered by its extensive starts database, ConstructConnect, in partnership with Oxford Economics, a world leader in econometric modeling, has developed put-in-place construction statistics by types of structure for U.S. states, cities and counties, actuals, and forecasts. ConstructConnect’s PIP numbers are being released quarterly and are featured in a separate report.

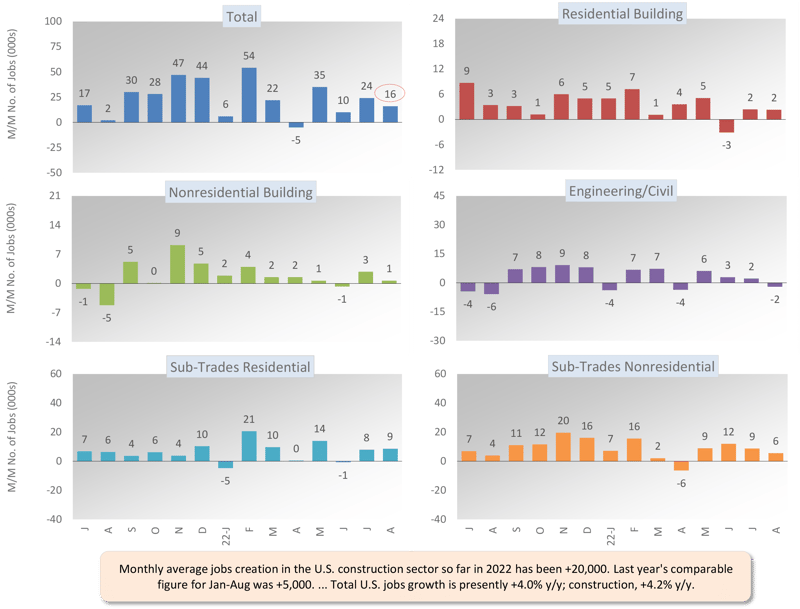

Construction’s share of U.S. total nonfarm employment in the monthly Employment Situation report is slightly more than 5.0%. To claim its proportional share of August’s economywide number-of-jobs increase of +315,000, the figure for construction would be +16,000. Lo and behold, that’s exactly what it was, +16,000.

The year-to-date monthly average of construction employment is now +20,000 jobs versus +5,000 in Jan-Aug 2021. In August 2022, residential (+9,000) and nonresidential (+6,000) subcontractors provided nearly all the month-to-month lift in the total construction jobs count.

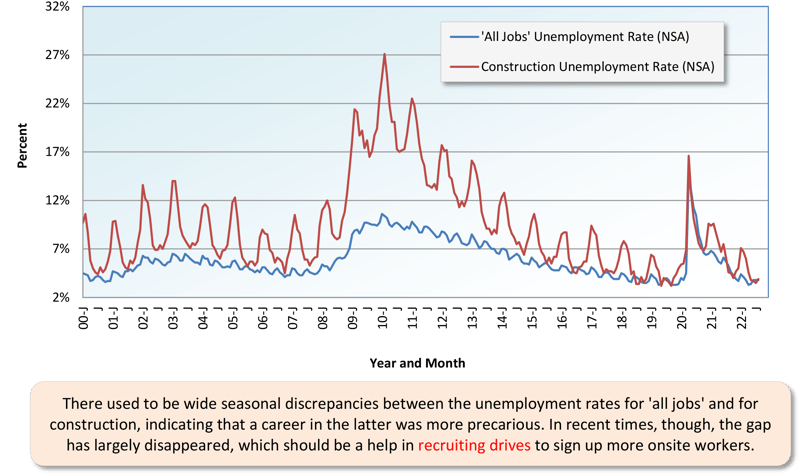

Construction’s not seasonally adjusted unemployment rate in August was 3.9%, placing it about on a par with the all jobs rate of 3.8%. The latest NSA U rate for construction wasn’t quite as tight as the prior month’s 3.5%, but it was an improvement versus August 2021’s 4.6%.

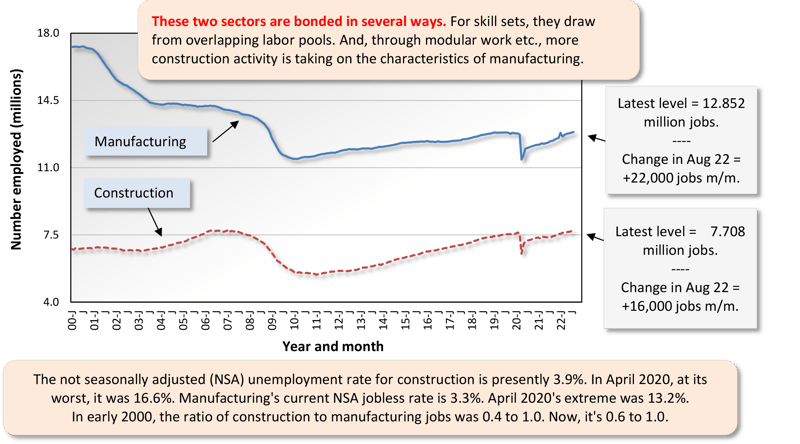

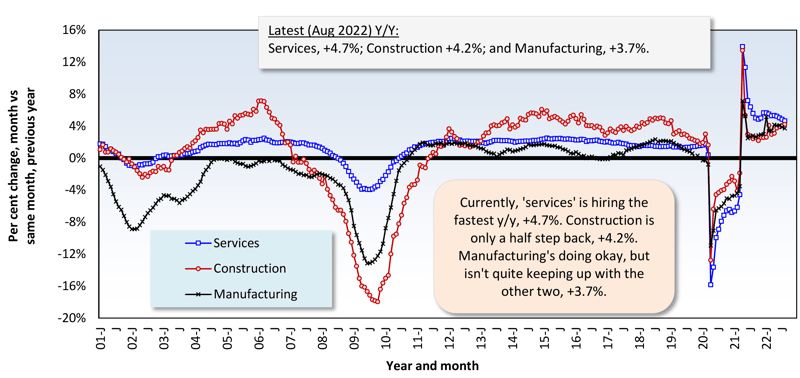

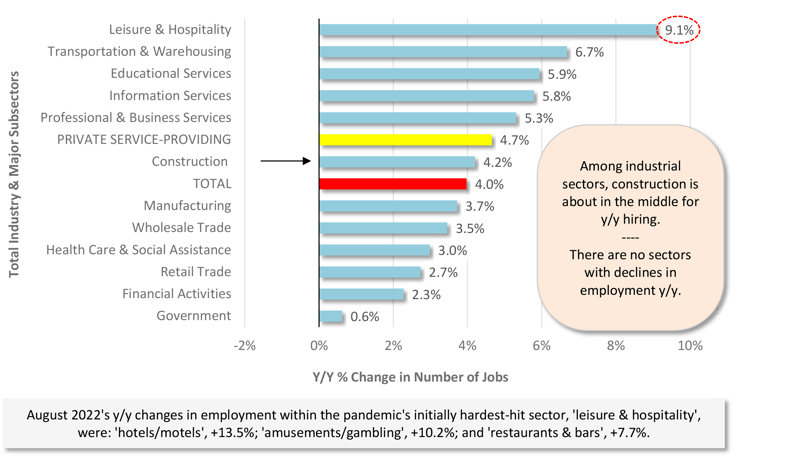

August’s year-over-year gain in construction employment, at +4.2%, was a little speedier than the all jobs y/y pickup of +4.0%. It also beat manufacturing’s +3.7% jobs gain. The sector hardest hit by the pandemic, leisure and hospitality, saw a y/y jobs leap in August of +9.1%.

n other segments of the economy with close ties to construction, the latest y/y percentage changes in employment have been as follows: oil and gas exploration and development, +18.8%; architectural and engineering design services, +6.3%; machinery and equipment rental and leasing, +6.0%; cement and concrete product manufacturing, +2.9%; real estate, +2.8%; and building materials and supplies dealers, -0.7%, or virtually no change.

Design services work leads to later on-site activity. Therefore, the +6.3% increase for design services jobs is a positive read on the prospects for future hardhat employment. Furthermore, the latest (July 2022) Architecture Billings Index from the American Institute of Architects, which provides a gauge of the demand for construction design services, was 51.0 in August, down from 53.2 in June. While still healthy, it’s approaching the 50.0 benchmark figure that separates more sales from fewer, month to month.

Graph 1: Change in Level of U.S. Construction Employment, Month to Month (M/M) −

Total & by Categories - August 2022

Graph 2: U.S. Manufacturing Versus Construction Employment - August 2022 - Seasonally Adjusted (SA) Payroll Data

Graph 3: U.S. Unemployment Rates: All Jobs & Construction — August 2022 (Not Seasonally Adjusted)

Graph 4: U.S. Employment - August 2022 - % Change Y/Y (Seasonally Adjusted)

Graph 5: U.S. Total & Subsectors Y/Y Jobs Change - August 2022 (Seasonally Adjusted)

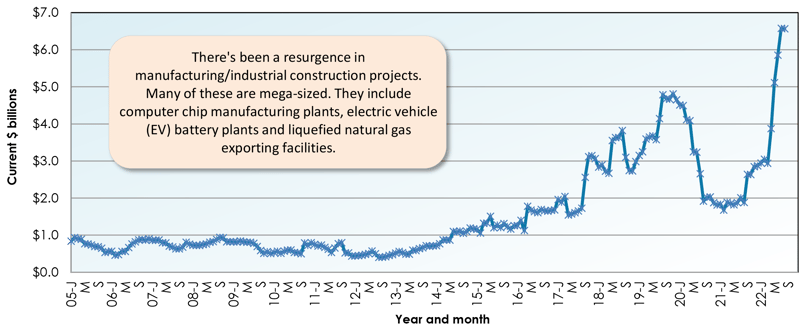

Graph 6: U.S. Manufacturing Construction Starts - ConstructConnect (12-Month Moving Averages)

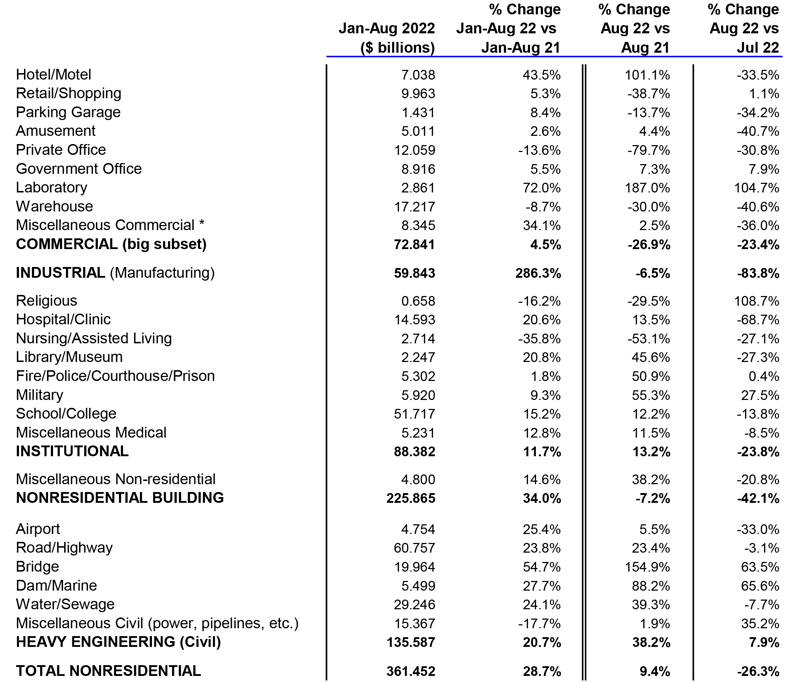

August 2022’s total nonresidential starts’ setback of -26.3% m/m originated mainly in the industrial subcategory (-83.8%), although institutional and commercial were out of sorts as well, and to almost matching degrees, -23.8% and -23.4% respectively. Only heavy engineering/civil took a step forward, +7.9%.

The +9.4% advance of total nonresidential starts in August of this year versus August of last year was thanks to the buoyancy in engineering (+38.2%) and institutional (+13.2%) that wasn’t swamped by the negativity in commercial (-26.9%) and industrial (-6.5%).

As for August’s year-to-date gain of +20.7% for total nonresidential starts, it drew strength from all the major subcategories, with industrial +286.3%; engineering, +20.7%; institutional, +11.7%; and commercial, +4.5%. To date in 2022, it’s been an exceptional year for megaprojects.

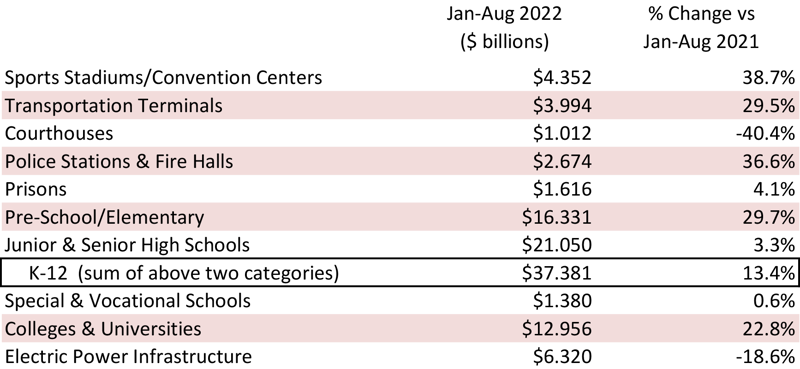

There are two dominant subcategories of total nonresidential starts. When the volumes of roads/highways and schools/colleges are added together, they account for 31.1% of August’s total nonresidential starts YTD, i.e., shares of 16.8% and 14.3%, respectively.

The three percentage-change metrics for street starts in August 2022 were -3.1% m/m, but +23.4% y/y, and +23.8% YTD. Educational facility starts in the latest month were -13.8% m/m, but +12.2% y/y and +15.2% YTD. The pickup in school starts is being driven primarily by preschool and elementary structures, +29.7% YTD, and colleges and universities, +22.8% ytd.

Important beyond roads within the engineering subcategory are water/sewage and bridge starts. The groundbreaking performances in the former in August were -7.7% m/m, but +39.3% y/y, and +24.1% YTD. For the latter, the results were uniformly outstanding: +63.5% m/m, +154.9% y/y, and +54.7% YTD.

Important beyond schools in institutional are three medical subcategories, i.e., hospitals/clinics, ‘nursing/assisted living, and miscellaneous medical. Their combined starts in August 2022 were -56.1% m/m and -5.7% y/y, but +7.5% YTD. Hospital/clinic starts on their own were +20.6% YTD, although nursing/assisted living starts were -35.8% YTD.

Among commercial starts in August, impressive year-to-date increases have been recorded by laboratories (+72.0%), hotels/motels (+43.5%), and miscellaneous (+34.1%). The latter includes sports stadiums/convention centers (+38.7% YTD) and transportation terminals (+29.5% YTD). Government office buildings (+5.5% YTD), retail/shopping (+5.3% YTD), and amusement (+2.6% YTD) are making minor headway. Warehouses (-8.7% YTD) and private office buildings (-13.6%) are struggling at the moment.

None of the foregoing, though, is as impressive as what’s been happening in the industrial subcategory. Manufacturing starts in August have been -83.8% m/m and -6.5% y/y; but, due to the greenlighting of many really large projects earlier in 2022, they are an eye-popping +286.3% YTD.

Table 2: Construction Starts in Some Additional Type of Structure Subcategories

This Industry Snapshot sets out the history, from January 2005 to the present, of 12-month moving ConstructConnect starts averages for a dozen construction types of structures. The moving average (placed in the latest month) approach is designed to capture trends.

The slopes of many of the graphs are now inclining fairly emphatically. Unfortunately, there are three exceptions. Private office buildings, retail, and miscellaneous civil are having trouble breaking free from pandemic-imposed lethargy.

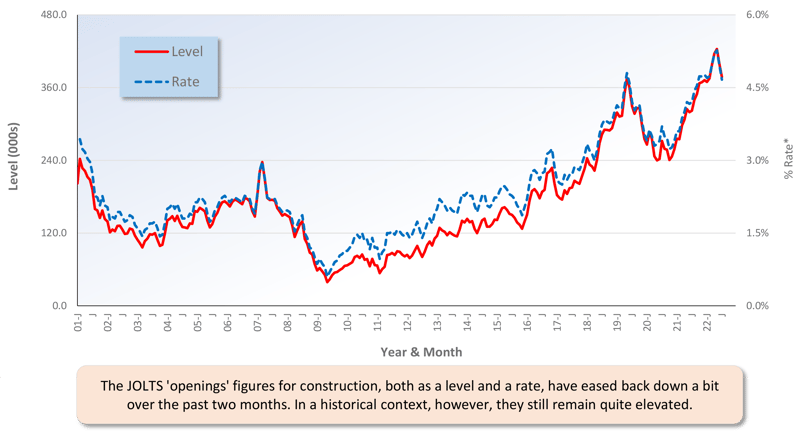

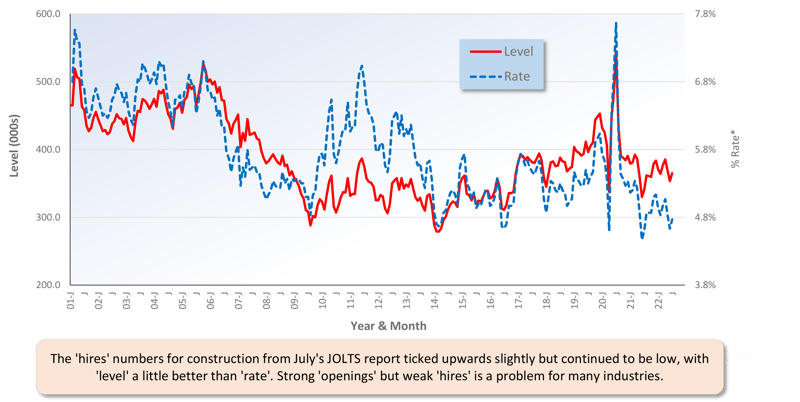

For ease of viewing, Graphs 5 and 6 show smoothed curves (i.e., based on three-month moving averages) for the Job Openings and Labor Turnover Survey results pertaining to construction industry openings and hires.

The JOLTS story remains the same as it has been for a while now. There’s an excess of openings, but filling those positions is meeting with only limited success. Moreover, this is a problem not limited to construction.

An aging population, with accompanying retirements, is depleting the labor pool. Plus, everyone involved in hiring should be aware that the competition for workers is about to become exponentially stiffer, given that employment opportunities are widening in so many new ways (e.g., jobs in AI, the metaverse, blockchain development, climate change disaster mitigation, etc.)

Graph 7: U.S. Construction Job Openings (from JOLTS Report)

(3-month Moving Averages placed in Latest Month)

Graph 8: U.S. Construction Job Hires (from JOLTS Report)

(3-month Moving Averages placed in Latest Month)

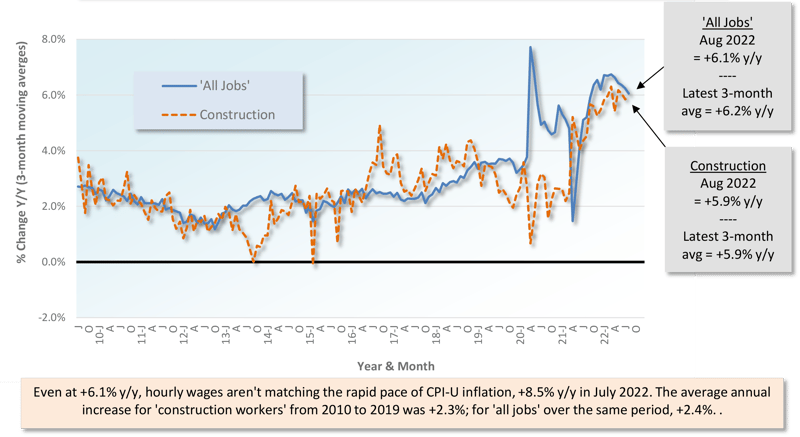

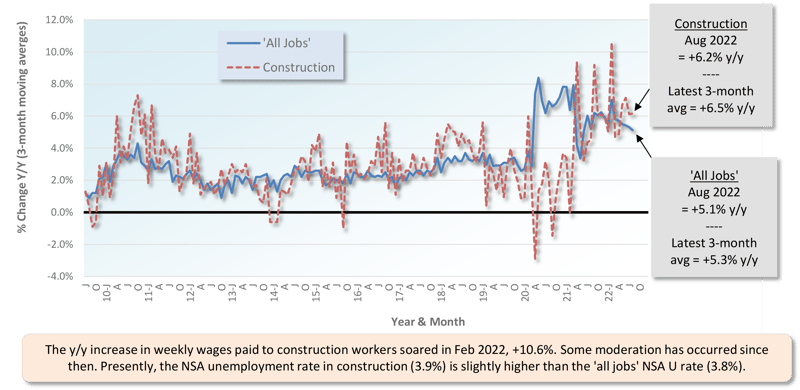

Tables B-3 and B-8 of the monthly Employment Situation report, from the BLS, record average hourly and average weekly wages for industry sectors. B-3 is for all employees (i.e., including bosses) on nonfarm payrolls. B-8 is for production and nonsupervisory personnel only (i.e., it excludes bosses). For all jobs and construction, there are eight relevant percentage changes to spotlight.

From August 2022’s Table B-3 (including bosses), year-over-year all-jobs earnings were +5.2% hourly and +4.6% weekly. Construction workers, as a subset of all jobs, did marginally better with y/y hourly and weekly increases of +5.3% in both instances. From Table B-8 for production and nonsupervisory workers (i.e., excluding bosses), the all-jobs wage advances were +6.1% hourly and +5.1% weekly. Construction workers didn’t quite keep up hourly, +5.9%, but they soared ahead weekly, +6.2%.

Graph 9: Average Hourly Earnings Y/Y - All Jobs & Construction

Graph 10: Average Weekly Earnings Y/Y - All Jobs & Construction

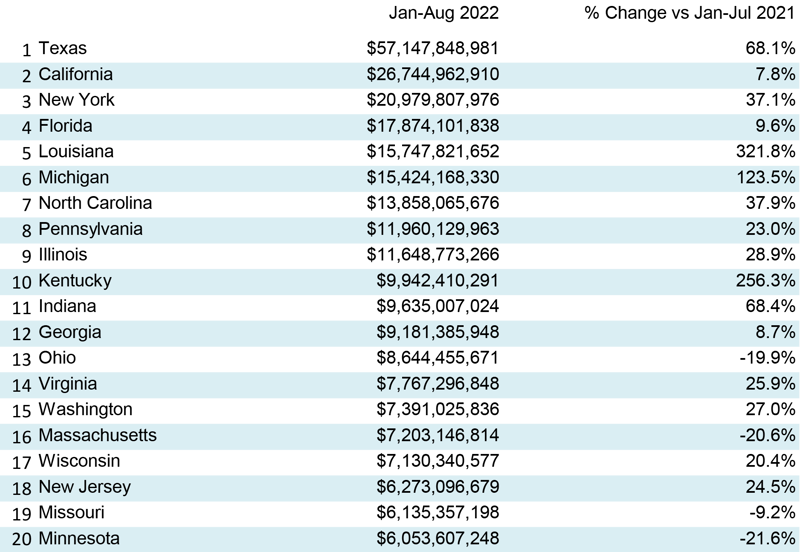

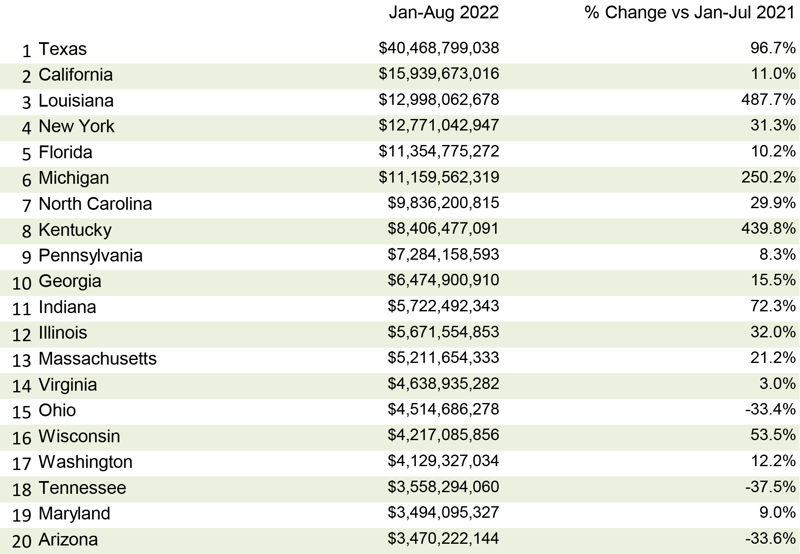

Table 3: 2022 YTD Ranking of Top 20 States by $ Volume of Nonresidential Construction Starts — ConstructConnect®

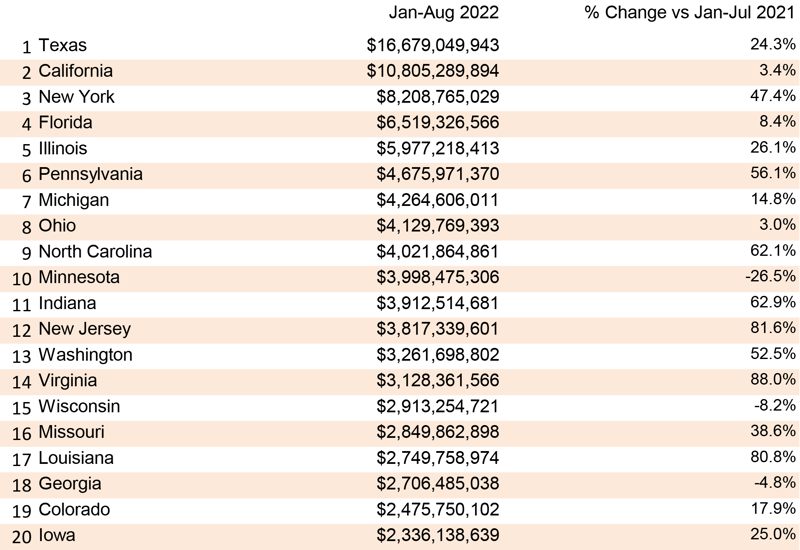

Table 4: 2022 YTD Ranking of Top 20 States by $ Volume of Nonresidential Building Construction Starts — ConstructConnect®

Table 5: 2022 YTD Ranking of Top 20 States by $ Volume of Heavy Engineering/Civil Construction Starts — ConstructConnect®

August 2022’s y/y results for three building related BLS Producer Price Index (PPI) series were: (A) construction materials special index, +9.0% (a little under July’s +10.5%); (B) inputs to new construction index, excluding capital investment, labor, and imports, +12.1% (a smidge over the previous month’s +11.8%); and (C) final demand construction, designed to capture bid prices, +22.9% (barely moving away from the prior month’s figure of +23.0%).

(A) comes from a data series with a long history, but it’s confined to a limited number of major construction materials. (B) has a shorter history, but it’s more comprehensive in its coverage, although it includes some items (e.g., transportation) that aren’t strictly materials.

Concerning the cost of some major construction material inputs, as revealed in the PPI data set for August 2022 published by the BLS, asphalt is +60.6% y/y; diesel fuel is +53.8%; gypsum, +18.4%; softwood lumber, +14.8%; hot rolled steel bars, plates, and structural shapes, +12.7%; ready-mix concrete, +11.0%; cement, +9.8%; aluminum mill shapes, -3.9%; and copper wire and cable, -5.6%;. There’s also an inputs to highways and streets PPI index and it’s +13.1% y/y.

The value of construction starts each month is derived from ConstructConnect’s database of all active construction projects in the United States. Missing project values are estimated with the help of RSMeans’ building cost models. ConstructConnect’s nonresidential construction starts series, because it is comprised of total-value estimates for individual projects, some of which are super-large, has a history of being more volatile than many other leading indicators for the economy.

ConstructConnect’s total residential starts in August 2022 were +15.3% m/m, -9.3% y/y, and -0.8% ytd. Multi-family starts in August were +46.0% m/m, -2.2% y/y, and +8.5% YTD. Single-family starts were +2.5% m/m, -13.0% y/y, and -4.5% YTD.

Including home building with all nonresidential categories, Grand Total starts in August 2022 were -12.6% m/m, +0.4% y/y, and +15.0% YTD.

ConstructConnect adopts a research-assigned start date. In concept, a start is equivalent to ground being broken for a project to proceed. If work is abandoned or rebid, the start date is revised to reflect the new information.

Broad measures of supply chain performance in recent months have improved considerably. The most well-known of these may be the Manufacturing Supplier Deliveries Index produced by the Institute for Supply Management. Readings below 50 suggest faster or quickening delivery performance, while readings above 50 indicate lengthening delivery times.

In the nearly 10-year period after the Great Recession and prior to COVID-19, the Index averaged 54.4. As a result of supply chain and operations disruptions stemming from COVID-19, index readings for much of 2020 and early 2021 reached historic highs. However, since the fourth quarter of 2021, readings have frequently signaled an improvement in supply chain performance. The latest available reading, representing August’s performance, measured 55.1, landing well within historical norms.

Furthermore, inventory-to-sales readings, which serve as a useful measure of inventory levels relative to customer demand, have also returned to pre-pandemic norms. However, the outlook for supply chain experts is not without some hazards. In the immediate future, a lack of transportation labor poses a significant threat to the efficient and timely delivery of goods. In both the railroad and trucking sectors, the number of employed drivers, conductors, and yardmasters has fallen significantly since 2020. - Michael Guckes, Senior Economist

A rule of thumb is that nonresidential construction is a lagging indicator among economic measures. Companies are hesitant to undertake capital spending until their personnel needs are rapidly expanding and their office square footage or plant footprints are straining capacity. Plus, it helps if profits are abundant. Also, today’s greater tendency to work from home has made office occupancy and the resulting need for construction much more difficult to assess. The rule, however, may not hold true under the present circumstances, with the weakness in such areas as retail spending to be offset by a rich deposit of large industrial and engineering construction projects to mine.

Each month, ConstructConnect publishes information on upcoming construction projects at its Expansion Index.

The Expansion Index, for hundreds of cities in the United States and Canada, calculates the ratio, based on dollar volume, of projects in the planning stage, at present, divided by the comparable figure a year ago. The ratio moves above 1.0 when there is currently a larger dollar volume of construction prospects than there was last year at the same time. The ratio sinks below 1.0 when the opposite is the case. The results are set out in interactive maps for both countries.

Click here to download the Construction Industry Snapshot Package - August 2022 PDF.

Click here for the Top 10 Project Starts in the U.S. - August 2022.

Click here for the Nonresidential Construction Starts Trend Graphs - August 2022.

Table 1: Value of United States Nonresidential Construction Starts August 2022 - ConstrucConnect

*Includes transportation terminals and sports arenas.

Source: ConstructConnect Research Group and ConstructConnect.

Table: ConstructConnect.

Table 6: Value of United States Construction Starts

ConstructConnect Insight Version – July 2022

Arranged to match the alphabetical category drop-down menus in Insight

Table 2 conforms to the type-of-structure ordering adopted by many firms and organizations in the industry. Specifically, it breaks nonresidential building into ICI work (i.e., industrial, commercial, and institutional), since each has its own set of economic and demographic drivers. Table 3 presents an alternative, perhaps more user-friendly and intuitive type-of-structure ordering that matches how the data appears in ConstructConnect Insight.

Source: ConstructConnect.

Table: ConstructConnect.

Table 8: U.S. YTD Regional Starts

Nonresidential Construction* — ConstructConnect

Data Source and Table: ConstructConnect.

Table 9: Value of United States National Construction Starts – July 2022 – ConstructConnect

Billions of current $s, not seasonally adjusted (NSA)

*Figures above are comprised of nonres building and engineering (i.e., residential is omitted).

Data Source and Table: ConstructConnect

Alex Carrick served as Chief Economist at ConstructConnect for over 39 years. He retired in 2024.

ConstructConnect announced today that July's volume of construction starts, excluding residential work, was $53.7 billion.

ConstructConnect announced today that July's volume of construction starts, excluding residential work, was $53.7 billion.

The Construction Economics Brief produced by ConstructConnect’s economics team is a monthly video series with brief and pertinent construction...

ConstructConnect reports the top ten nonresidential construction starts monthly in the Construction Economy Snapshot from Michael Guckes Chief...